Never traded stocks and aren't even sure how to start? You're in the right place! In this detailed post, I will walk through each step to get you up and running with Robinhood stock trading in just a few minutes. Plus, you'll get a FREE stock immediately to start your stock investing journey off on the right foot!

I procrastinated on trading stocks for years because I just didn't know how to get started. It seemed very intimidating and I realized there wasn't much content out there that taught newbies in a judge-free zone how to get started in the stock market. Let's change that now!

This is a true beginner's guide for getting started with Robinhood stock trading. Plus, you'll get a FREE STOCK to start you off on the right foot! I break down every step below and give a high level overview to get you started the easiest way possible.

How I Learned to Trade Stocks

I've always been interested in the stock market and wall street. In fact, I've been invested in the stock market since I was 19, but I had a financial advisor that managed my portfolio for me since I knew absolutely nothing.

I was so interested in the stock market, but never knew how to get into trading of my own. Most of the research I did online was not for a true beginner. The brokerage companies were scary and had fees that terrified me. The platforms and websites were intimidating and had so much going on, it was a huge turn off for a beginner like myself.

The youtube videos I saw that were labeled “Beginner Stock Trading” would talk about 3-bar plays and options. Ummm…what? How about we start with what a dividend is for goodness sakes. They just didn't seem “beginner” to me. I sat there watching the screen completely glazed over. Anyone with me on that?

I needed a TRUE beginner's guide to stock investing, but nothing existed. Therefore, I ended up having to teach myself everything I know organically. I spent years reading books, checking the newspaper, analyzing articles, watching youtube videos, and listening to podcasts. There's so much to learn and it definitely takes time. It's not my day job, it's my hobby so it was an escape from work to try to make more money after my day job. =)

Why Invest in the Stock Market?

The true income potential from the stock market is unbelievable. I've been invested in stocks and mutual funds (we'll touch on mutual funds in a separate post) since I was 19. That means that I've been invested in the stock market for 13 years!

My money in the stock market gives a return on investment of 7-14% a year on average. If you do the math, you can see how compound interest adds up over the years. You really can become a millionaire with time by investing very little and letting compound interest snowball over time.

I love talking to my friends and readers about the importance of investing in the stock market. In fact, I get questions all the time about how to do it, how to get started, how to invest, etc. I realized that almost every friend of mine is not invested in the stock market, doesn't know how, and is overwhelmed by it.

Don't worry though! I'm here to help. I am going to break down each of the steps to get you invested in the stock market quickly and in the easiest way possible! By the end of this 10 minute tutorial, I guarantee you will have money invested in the stock market (including the free money you will get from this post) and will be actively positioned to trade stocks! Woohoo!

Related Articles:

- Beginner’s Guide to Investing: Step by Step Tutorial on How to Invest

- What is a 401k and Do You Need it NOW?

- Financial Cookbook Easy to Understand Definitions

- Dividend Stocks for Beginners: Guide for the New Stock Investor

Why Robinhood Stock Trading Changed the Game

Over the years, I realized I wasn't alone in my intrigue for the stock market. My friends and colleagues asked me questions constantly and also wanted to get into trading. However, they also were having the same difficulty with the barrier to entry that I had. It was intimidating, scary, and like drinking from a fire hose so they'd get frustrated and give up. I get it. I was there as well at one point.

Claim Your Free Robinhood Stock HERE! No strings attached, no billing, no subscriptions. I'm just glad to be able to offer this to my readers because Robinhood is how I got started as well! =)

When Robinhood started to gain traction as a reputable brokerage, I gave it a shot even though I had other brokerages I was already using. They offered no commissions and no fees. Impressive. I figured there was a catch.

There wasn't.

I was so impressed with the app and platform that when my friends inquired about stock investing, I was able to easily teach them about investing through Robinhood stock trading. In fact, I was able to help them make money in the stock market by using the app.

Their no-commission trades and $0 fees are a HUGE deal for a beginner investor. Robinhood is still my absolute favorite novice brokerage hands-down and is the quickest way to get your feet wet in the stock market.

Now, I'm here to do the exact same for you!

In fact, within just 5-10 minutes, we will have your brokerage account set up, money ready to trade with and you'll own your first stock with no money out of pocket from you! You ready?

It's an exciting moment! Let's GO!

True Beginner's Guide to Robinhood Stock Trading

Before we dive right in to the fun part of Robinhood stock investing, let's get some of these important first steps out of the way that I need to mention to make sure I am laying out all of the important fundamentals of stock investing.

1.) Importance of an Emergency Fund

Please, please make sure you have at least 3-6 months of emergency funds available in your bank account (not invested anywhere). This money can be in a high yield savings account or in a checking account through Chase, Bank of America, etc. Just make sure you have it and that it's easily accessible in case of an emergency.

To learn more about emergency funds, read my Ultimate Guide to an Emergency Fund (including a free download) here.

Emergency funds are extremely important as they are a safety net that can be used in case of a job loss, unexpected medical/pet bills, etc. Analyze your current financial situation and make sure to keep 3-6 months of funds in a savings account to cover your rent and recurring bills in case of emergency.

Ok, now on to the fun stuff!

2.) Download the Robinhood App here and get a FREE stock upon sign up!

Told ya we were gonna have some fun!!

YES, you read that correctly! There is absolutely no cost for the Robinhood App or service and yet they will give you a FREE stock upon signing up here.

No strings attached!!!

The free stock will be picked at random, but you could end up with an Apple or Facebook stock! Either way, it's free money! I guaranteed you'd finish this post with money in the stock market, didn't I? =)

Feel free to tell me in the comments below what stock you got! I love hearing which stock people get! The app will look like this:

Robinhood is my favorite stock brokerage app by far! It is EXTREMELY easy to use so it's perfect for a beginner. The interface is appealing and it's extremely fast.

In fact, I use 4 other stock brokerages and this one is hands down my favorite and always will be. The simplicity is amazing and getting a free stock upon sign up without having to add any money AT ALL (no stipulations) is amazing! It doesn't get better than that!

After downloading Robinhood, it should take you through a series of steps. It will ask for some personal information. You DO need to enter it because the IRS will receive income reports from the transactions through the app. Robinhood is one of the largest stock brokerage companies in the world, so it's safe to do so! Fill out the information to get to the fun part.

After you make it through all of the steps, it will ask you to claim your free stock within the Robinhood stock trading app! Woohoo!

You are officially a stock investor, but let's keep going through our tutorial and dive into understanding the app and how it works!

Other Money Saving Articles:

- How to Refinance Your Mortgage (Step by Step Tutorial)

- Ultimate List of 50+ Things You Should ALWAYS Buy at Dollar Tree

- Food on a Budget: 24 Ways to Save Money on Groceries

- 10 Genius Ways to Save Money Shopping

- Tips for Buying a Car: 18 Unique Things to Do to Save the Most Money

3.) How To Read a Robinhood Stock Trading Page

Let's start with how to read a stock page since this is the most important thing when investing your hard-earned money. I'm going to label each part of the stock page and describe what each number means below.

Go ahead and follow along as I go through this.

Click on the free stock they gave you.

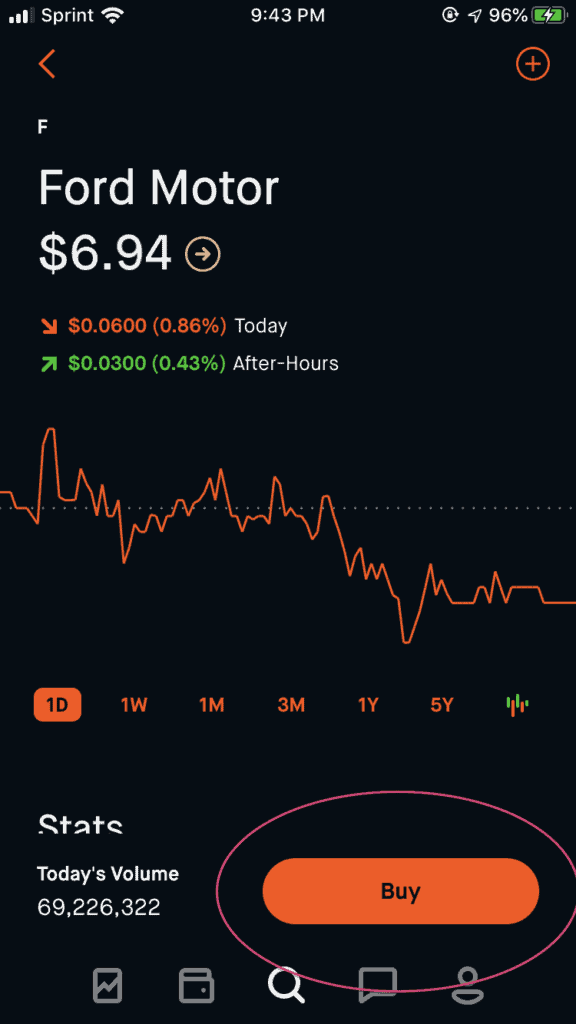

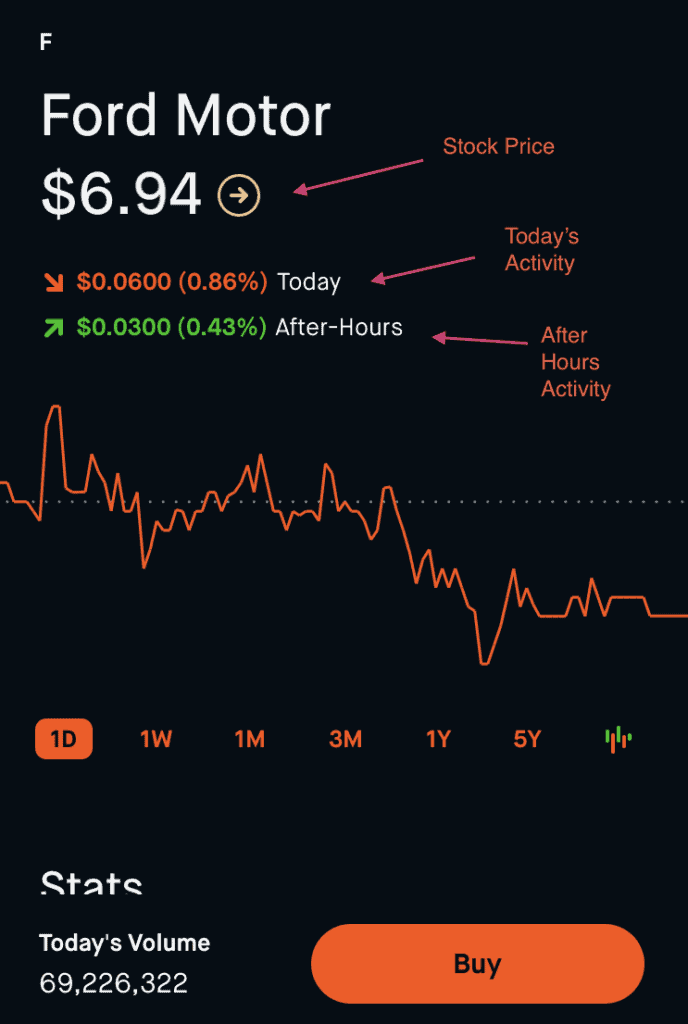

I'm going to open up the stock Ford (F) to demonstrate. It should look like the image below.

A) Stock Price- At the top, right under “Ford Motor”, you'll see a dollar amount. This is the amount the stock is trading for (or also known as its market value). This screen shows that 1 share of Ford currently costs $6.94.

B) Today's Activity- Below the stock price, you'll see a dollar amount with a percentage in parenthesis that says Today. That is showing the amount the stock has increased or decreased today during the market hours. The stock market is open 9:30am – 4pm EST. These are the hours you can trade stocks in.

C) After Hours Activity- Below today's changes is the After Hours movement. For now, I'd say don't even worry about this. Just for explaining purposes, this shows the dollar amount and percentage the stock price has changed after the close of the stock market.

You know how I mentioned the hours of the stock market above?

Well, some brokerages have after-hours trading available where you can trade outside of the regular hours.

Robinhood's stock trading after hours are 9am-6pm EST. This means that you get an extra 30 minutes in the morning and an extra 2 hours in the evening to trade stocks. HOWEVER, I highly recommend ONLY trading during official stock market hours of 9:30a – 4pm EST as a beginner. (We will talk more about after hours trading in another post.)

Now, follow along with me and scroll down in your app on the same stock page to where it says “Your Position”. Are you with me still?

YOUR POSITION:

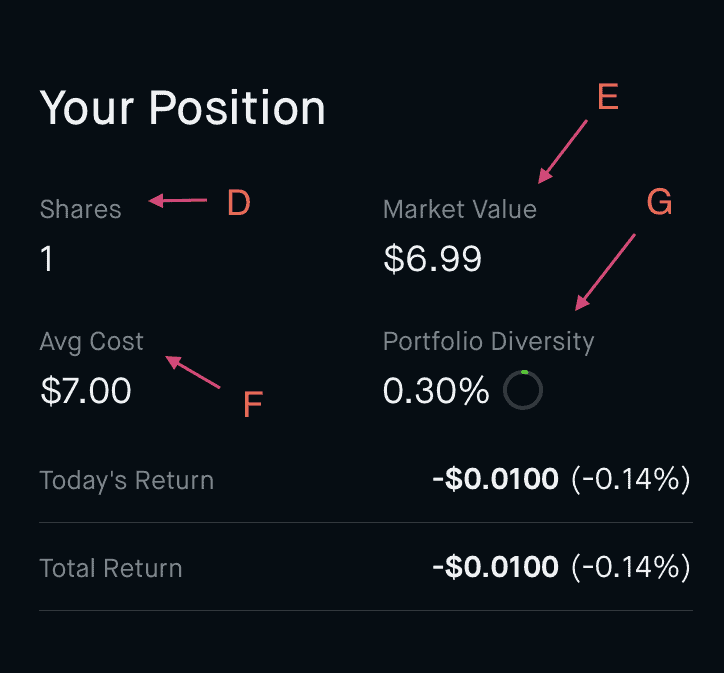

This is what it should look like:

D) Shares- This shows how many share you own. At this point, you should show 1 of the stock you got for free.

E) Market Value- This is the current value of your investment in this stock. For instance, you can see above that I own 1 stock with Ford.

The current stock price is $6.99 so I have:

1 share x $6.99= $6.99 (my market value).

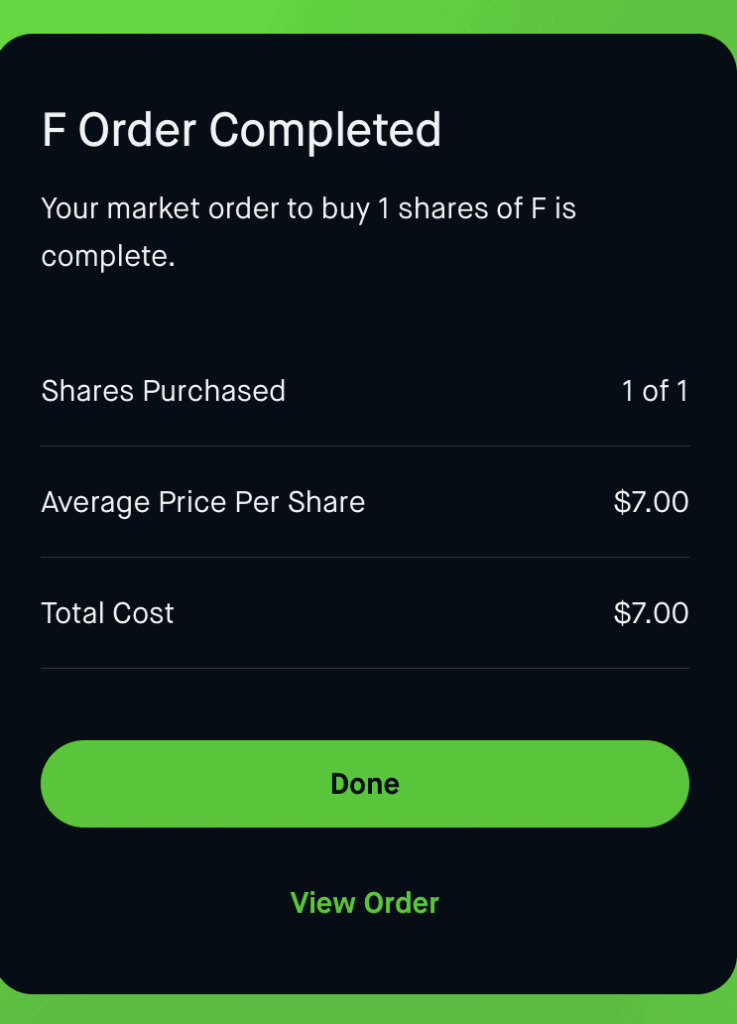

F) Avg Cost– This is the average cost of your shares.

I bought the stock at $7.00 so that is my cost. If I had bought 2 shares on one day and 3 shares on another day, this value F would average the cost I paid for all 5 shares. This value is important to watch as you will want to sell ABOVE this average cost to make money!

G) Portfolio Diversity– This one isn't as important for now, but it basically shows what percentage of this stock makes up your entire stock portfolio. Don't worry about it for now, but it's good to keep in mind.

H.) Today's Return- This is where it gets fun again. This stat shows you how much money you theoretically MADE today!! Now, keep in mind that you haven't actually made the money until you sell the stock. Right now, that's the value of the stock.

I.) Total Return- This stat is my FAVORITE!! This is the total amount you've theoretically made (not just today)!! However, I haven't officially made that amount until I sell the stock. This is the MOST IMPORTANT stat.

Tip: You want “Total Return” to show a positive dollar amount before you sell the stock in order to make money!

Related Articles:

If you're still with me, we'll move on to “Stats”! Just scroll down a bit more in the app.

Let me know if you need further explanation on anything. I'm happy to assist in any way I can!

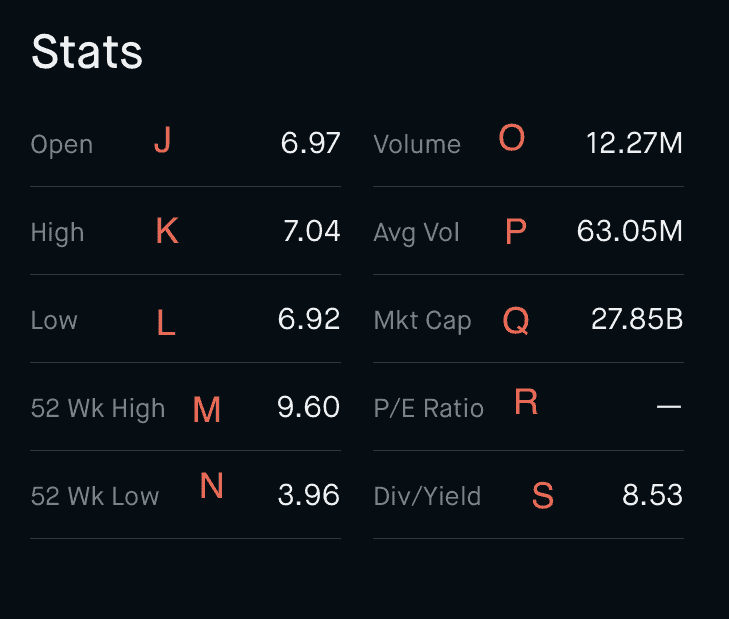

STATS:

These stats are extremely helpful for your stock research as they can help you determine what a stock's potential may be and how risky the stock is.

J.) Open- The share price the company started at this morning at 6:30am EST.

K.) High- The highest price the stock was at today.

L.) Low- The lowest price the stock was at today.

M.) 52 Week High- The highest price the stock was at over the last year.

N. ) 52 Week Low- The lowest price the stock was at over the last year.

O.) Volume- The quantity of shares that were traded today. For example, today Ford stock was traded 12.27M times.

P.) Avg Vol- The average quantity of shares the stock is normally traded at. I like to look at the volumes to determine if there's anything volatile going on in the market.

For example, one day I noticed double the amount of Disney shares traded compared to the average volume. When I looked into it further, I found that it was because Disney had announced the closing of some of their parks.

In many scenarios, the volume metrics help determine major market changes so that you can make good decisions on whether to buy/sell.

Q.) Mkt Cap- This stands for Market Capitalization. It shows the dollar value of a company's outstanding shares.

R.) P/E Ratio- This is the company's share price divided by its earnings per share. This metric (P/E Ratio) helps you understand how “expensive” a stock is based on its profitability. In other words, you can determine if the stock is undervalued or overvalued from the profit the company is bringing in.

S.) Div/Yield- This metric is the annual dividend divided by the stock price. It compares a company’s annual dividend to its share price.

Below the Stats, you will find News and other important stock information for research. However, we are going to stop here for now since we are only focused on the basics of stock investing to get you up and running today.

Wow! We did it! We made it through the stock pages. Are you still with me? Write me a comment below if you've made it this far and tell me what stock you got for free!

Now that we've got the basics out of the way, we're about to have some more fun!! It's time to put money into your Robinhood stock trading account to start investing in more stocks.

FUN = Making Money if you haven't caught on by now =)

4.) How to Transfer Funds into Robinhood

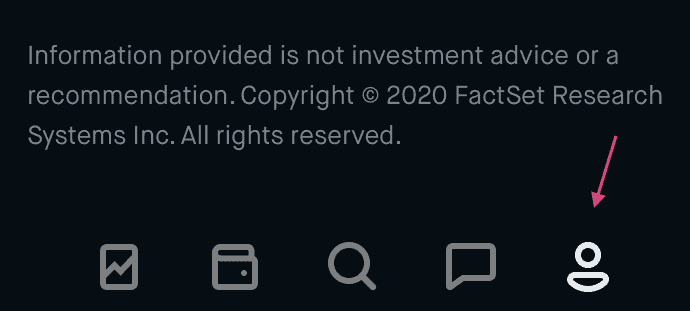

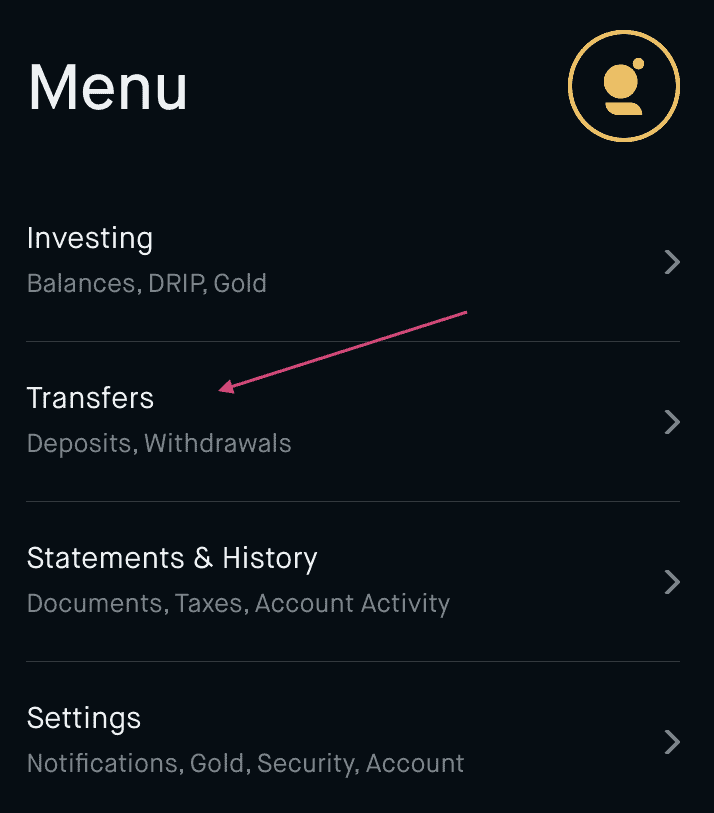

1.) Click on the little person in the lower right hand corner.

b.) Click on the hamburger (aka 3 stacked lines) in the top right hand corner

c.) Click on “Transfers”

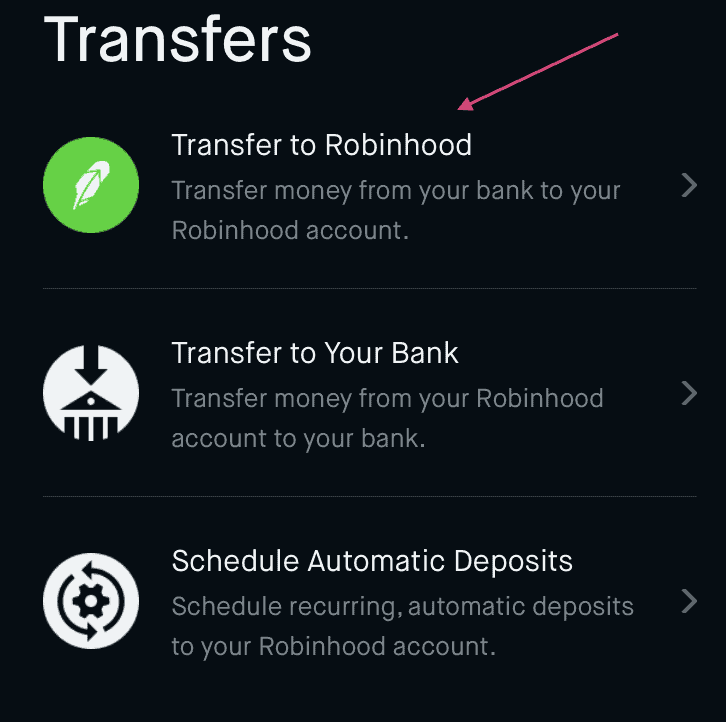

d.) Click on “Transfer to Robinhood”

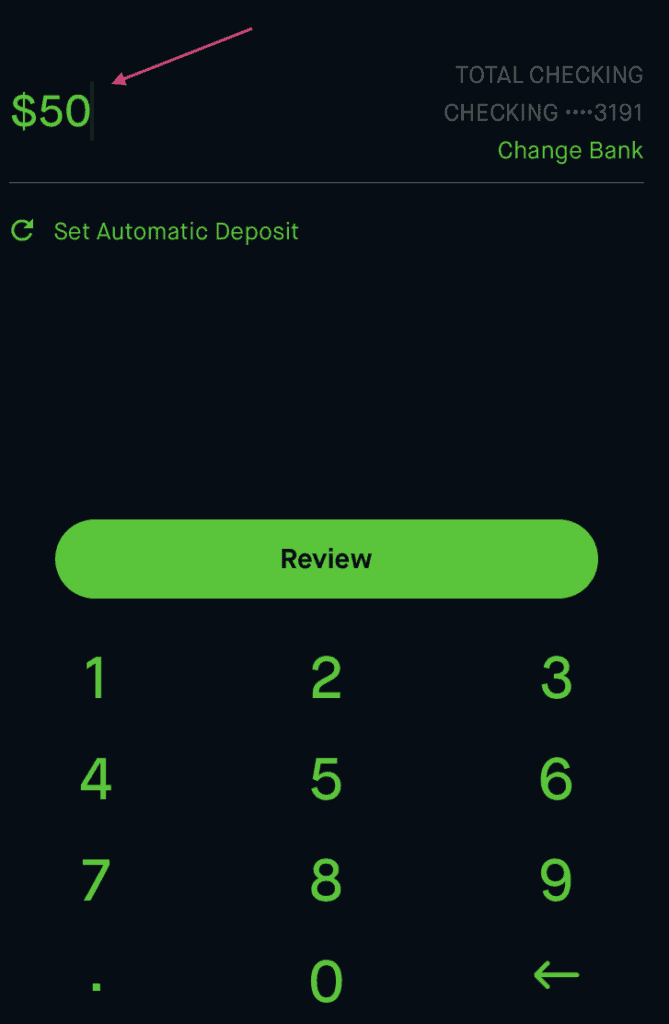

e.) Enter the dollar amount you want to start investing with.

My recommendation is to start with $50-$100 to play with until you get more comfortable. This will pull money out of the bank account you set up when you signed up.

Keep in mind that you want to make sure you save your Emergency Funds in your bank account so only take out an amount you feel comfortable with. Plan to keep your money in the stock market for as long as you can (until retirement ideally, but also plan on enjoying your life).

My favorite saying is “It's not timing the market, it's time in the market” meaning that you typically want to keep your money in there as long as you can to see the best return on investment.

Now, I know others will claim timing the market is better, but even highly skilled investors can't always time the market. The truth is, it's volatile and no one can predict it. A beginner stock investor should stick to investments, not day trading. I'll write a post on day trading soon though because I do love it!

f.) Click Review and then Submit!

*Please note that Robinhood processing could take 3-5 business days to transfer funds. The funds will come out of your bank account usually within a day so for about 3-5 days, it will be in limbo. If the amount you entered is under $1000, Robinhood will go ahead and credit your Robinhood account $1000 to let you get started with trading. If it's over $1000, they'll deposit $1000 in your account and the rest will go into your account when the money officially transfers in 3-5 days.

Now you've completed the money transfer! Let's move on to how you buy your own stocks (even though we know you already have your first free one!)

5.) How to Buy A Stock in Robinhood

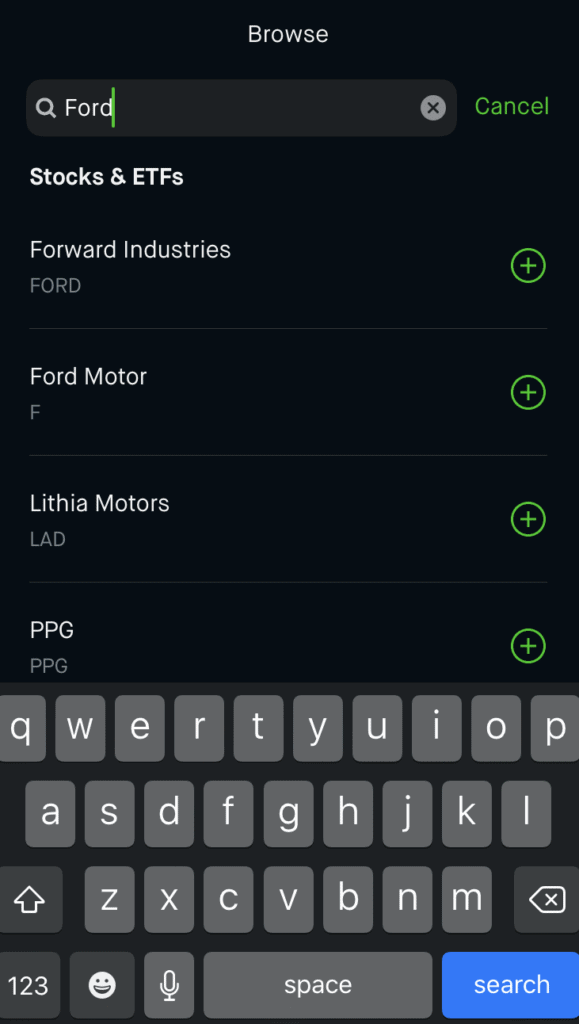

a.) Click on the magnifying glass in the bottom/middle of the app.

b.) Search for a company and click on it. (For demonstration purposes, I'll stick with Ford. Feel free to follow along in a stock you're interested in purchasing.)

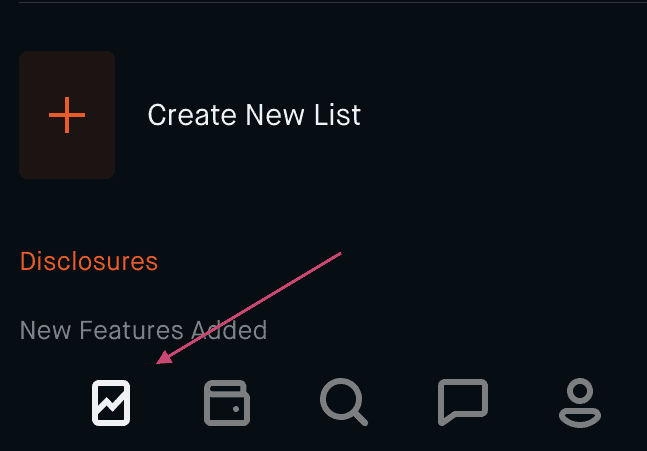

*Tip: To make a list of stocks you want to watch easily on your home page, click on the plus sign in the top right corner to create a new watch list! I LOVE the watch list feature in the Robinhood stock trading app!

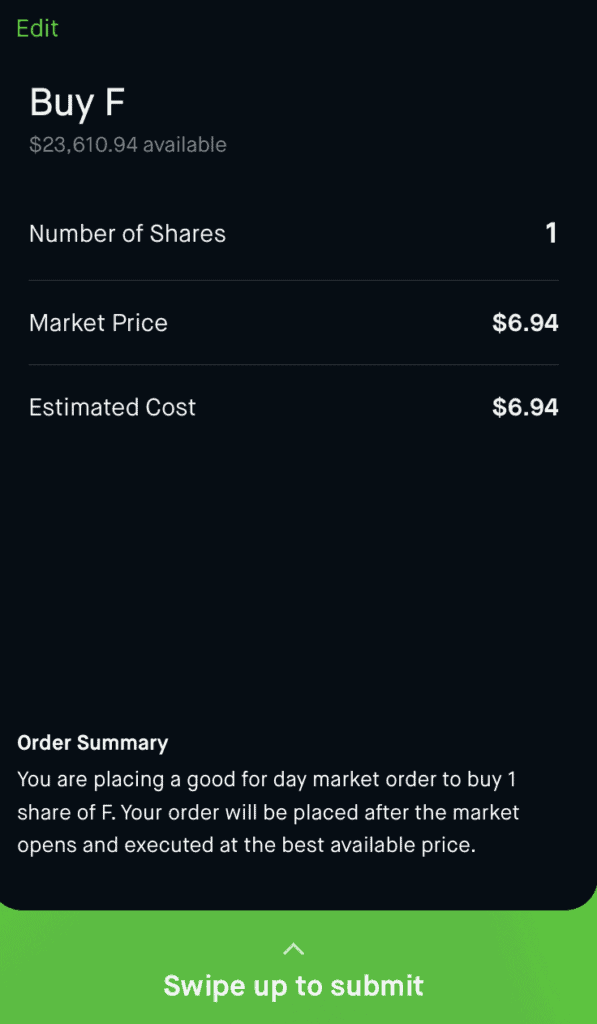

c.) Click the Button on the bottom that says Buy. Click on that button. (Don't worry, it won't buy anything yet.)

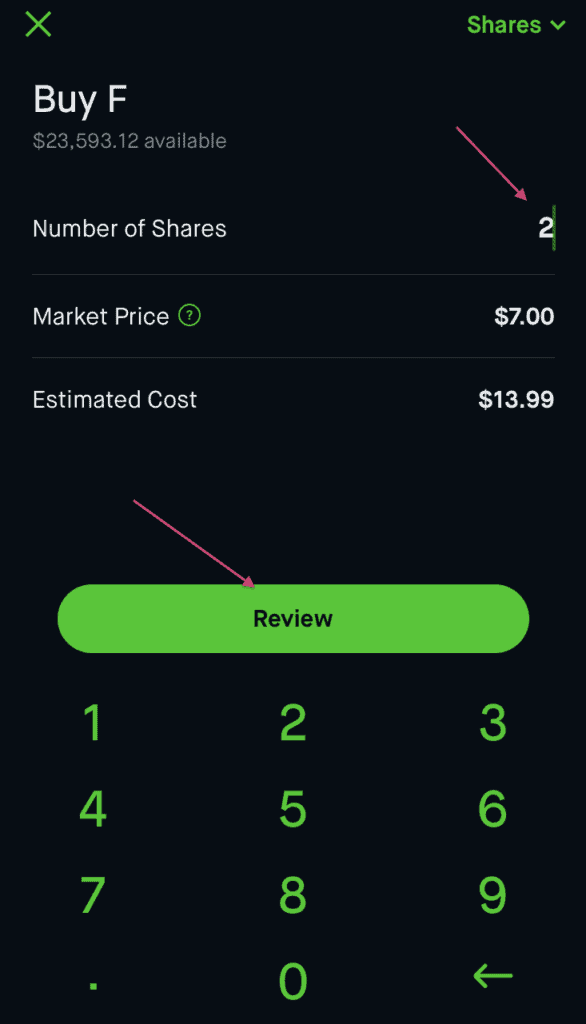

d.) Enter the number of shares you want to buy.

*Take note of the current market price (stock price) of that share in that moment. This is how much you will be buying it for. The estimated cost will show you how much (in total) your purchase will cost. 2 shares of Ford is going to cost me $13.99.

e.) Click Review (don't worry, it still won't charge you yet!)

*Keep in mind that the stock price is constantly changing so you may see it changing while you're in the middle of your purchase. That is totally fine and that's normal. The next step will determine your exact sales price.

f.) Swipe Up to Submit

This will OFFICIALLY purchase the stock and the shares you designated.

g.) You should now see an Order Completed page showing you the official price you paid for the stock. (I decided to just buy 1 stock)

h.) Now, click on the lower right-hand corner stock ticker icon. This is your home page and where you will spend most of your time.

i.) You should now see your newly purchased stock immediately under Stocks. So now you should have 2 stock purchases. The free stock that Robinhood gave you and the one you just purchased.

Beginner's Guide to Robinhood Stock Trading

Congratulations! You're now a stock investor! There's much more you can do in the Robinhood stock trading app, but this is a great start to get your feet wet in stock investing. If you made it through, I'd love to hear from you and hear what free stock you received/which one your purchased yourself and why!

This website is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

Thank you so much for an actual beginner’s guide! I was so intimidated, but now I’m learning how to start!

My spouse and I absolutely love your blog and find the majority of your post’s to be precisely what I’m looking for. Would you offer guest writers to write content to suit your needs? I wouldn’t mind publishing a post or elaborating on a lot of the subjects you write with regards to here. Again, awesome site!

I got OPK health. I also invested $1 into J&J – do you have an article touching on investing less than the share price?? Thank you!

Yay! That’s exciting! I don’t yet…what questions did you have in mind for that? =)

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

Very descriptive article, I loved that bit. Will there

be a part 2?