Refinancing a home can be nerve-wracking, but with the proper expectations, it's an easy process! This is a beginner's guide on how to refinance a mortgage.

I was nervous about the steps to refinance my home and made sure I understood EVERYTHING before I gave over financials and signed paperwork. Now that I've been through it painlessly, I'll share what I learned, set expectations, and gear you up with what to be prepared for when refinancing your mortgage.

9 Steps to Refinance Your Mortgage

I never thought I would refinance my mortgage, but I just recently did it since interest rates are so low right now and I'm so glad I did! I didn't pay a penny out of pocket, I kept the same amount of financing years I already had, and I'm saving $175,000 over the life of the loan. Talk about free money! It's a no brainer.

First, let's talk briefly about expectations. Refinancing can be stressful for some people, but if you're geared with the proper expectations, it will be a walk in the park!

Related:

A refinance is comprised of the following steps that I'll walk through in detail:

- Collect your Financial Documents

- Shop for a Mortgage Broker with “The Trifecta”

- Call your Current Broker to ask for a Payoff Statement

- Submit an Application to the New Broker

- Lock in Your Interest Rate

- Underwriting and Approvals

- Waiting Period

- Review the Closing Disclosure

- Sign at Closing with the Notary

1.) Get Your Financial Documents Ready

Gather your documents ahead of time so you aren't going crazy looking for them when they ask. Get organized so they're easy to find.

These are the documents you'll want to have in hand and ready (they will ask for them):

- Last year's W-2

- Last 2 pay stubs

- Home Insurance Documents that show your premium (cost you pay) and coverage

- Copy of current Mortgage Loan Statement (from your current lender)

- Bank Account Statement (sometimes needed)

- HOA Documents (sometimes needed, if your home has an HOA) (HOA means Home Owner's Association. You'll know if you have one.)

2.) Find a mortgage broker with the “Trifecta”

There are 3 things you want to look for to get the most ideal refinance that will save you the most money and cause the least heartache.

It's what I call “The Trifecta”: low interest rate, no closing costs, and someone you trust.

Full article on The Trifecta can be accessed here.

However, let's first touch on looking up a broker and exactly what to tell them.

Do a simple google search for “refinance rates” or “low refinance rate”. Call the businesses that come up with low, attractive rates. Go ahead and give the broker your information. They can provide a verbal rate, but also have them give you a rate quote sent to your email. Tell them you want all charges/fees on the quote line-itemed out with descriptions of each cost. No exceptions on this one. They must send EVERYTHING. Tell them you do not want to be surprised later on and remind them that you will not go through with the loan if there is a surprise down the road. (Surprises typically mean extra fees you didn't know about, which means money leaving your pocket. We don't want that, right?)

Now go get at least two other quotes from other brokers. The key here is shopping it out. You want to make sure you get the best rate and quote possible to save you the MOST money.

Now let's talk about the “Trifecta” and exactly what to look for.

Let's look at the 3 quotes you got. The “Trifecta” will have the following 3 things:

1.) Low-Interest Rate

Look for the one with the lowest interest rate. This is the biggest factor of the Trifecta. Every .15% can mean A LOT of extra dollars you COULD be keeping in your bank account. Every dollar counts.

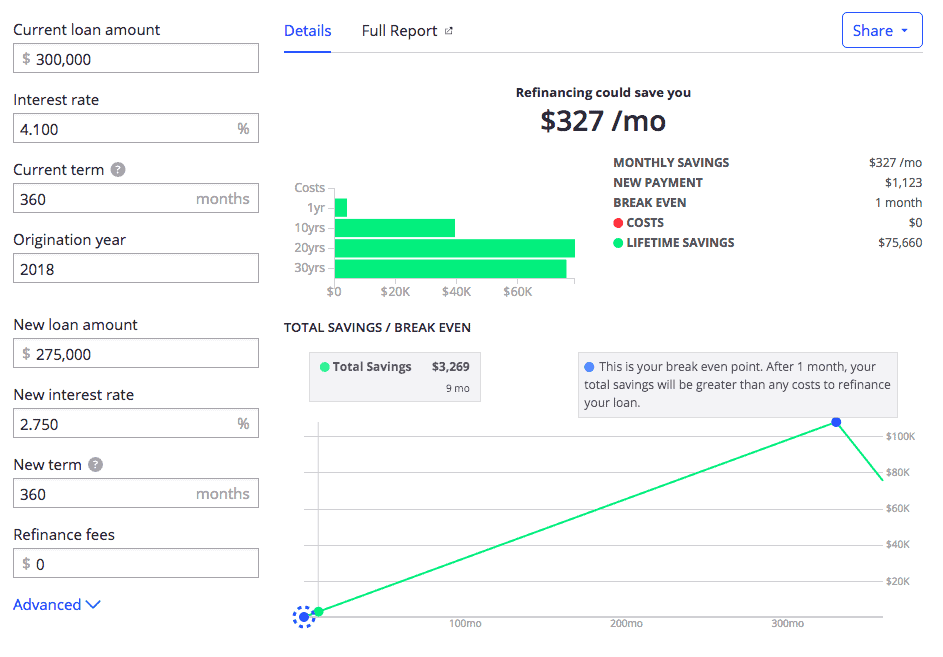

How do we calculate the savings? Go to the Zillow Refinance Calculator. Enter the details of your current loan first. The “current loan amount” is what your loan was when you first got it. Same thing on the “current term”. Most likely it was 15 or 30 years (aka 360 months).

Now, enter the details from one of the quotes you got. For now, keep the “refinance fees” at zero. We'll talk about that below. We will discuss the “new term” as well and how to decide what to do.

In my example above, you can see that this new loan would save $327/month. In the graph and details, you will break even the first month (that makes sense since we put refinance fees at $0).

Example 1: New Loan is 30 years and you plan to keep the home for 30 years:

If my new term is 30 years (aka 360 months), I will save $75,660 over the life of the loan (30 years) by refinancing.

Example 2: New Loan is 30 years and you plan to keep the home for 27 years:

If I keep the home for 27 years and have a loan of 30 years, I will save $107,890 because I will sell it after 27 years and not have to pay the last 3 years of payments.

Either way, it's a no brainer to refinance.

Choosing Your Loan Period:

Now, some companies will let you choose your term (i.e. 27 years, 24 years, etc). Now, you have something to think about: How many years do you want your new term to be?

Think about how long you plan to own the home for. Is it a condo that you plan to keep and rent out after you move out? Will you pass it down to your kids? Is it an investment property? Is it a home you plan to retire in? Basically, how long do you think you'd have it for? Play with the calculator to make the best financial decision for your goals.

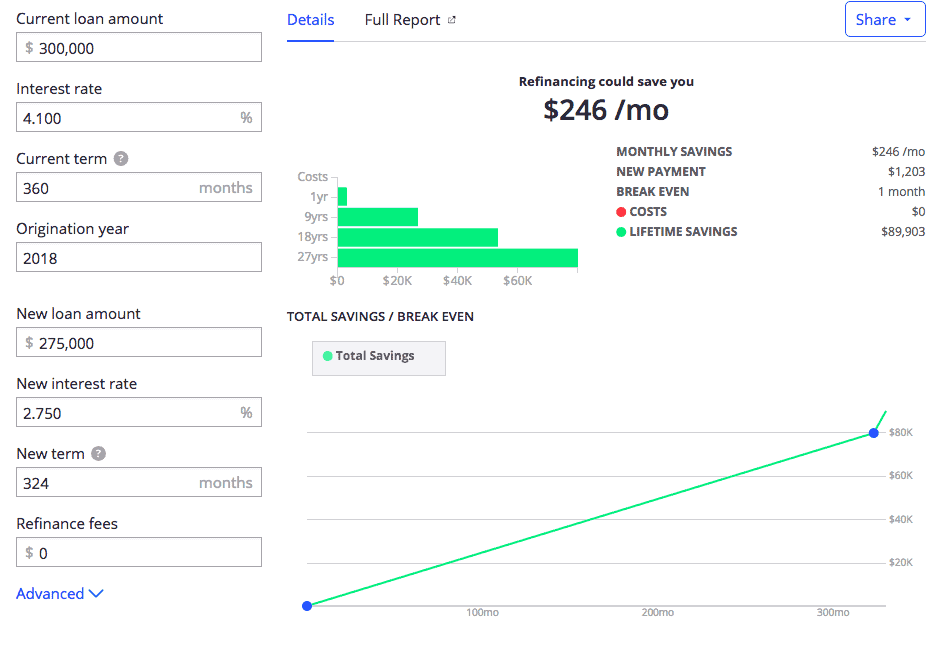

The answer to these questions matter because it will help you save even more money. See my example below.

We saw in Example 1 that if I stay in the home for another 30 years, I'd be saving $75,660 on a 30 year loan, but if I stay in the home for 27 years on a 30 year loan, I will save $107,890 (shown in Example 2 above).

Example 3: 27 year loan and keep the home for 27 years:

As you can see in the example above, if you do a 27 year loan and keep the home for 27 years, you will save $89,905 over the 27 years. That's more than $20,000 less than Example 2. Therefore, you'd want to do the 30 year loan and move out after 27 years. This will save you an extra $20k by doing it that way. Isn't math fun?!

Example 4: Selling home in 5 years:

If you are planning on selling the home in 5 years (for example), you should do the 30 year loan because you'd want to have the lowest payment possible. The zillow calculator will help you with deciding what is best for particular situation.

There's a lot of money that gets left on the table from people not doing their research to maximize their financial potential.

2.) No closing costs

Refinancing a mortgage does have closing costs (usually 2-3% of the loan). HOWEVER, there are plenty of mortgage brokerage companies that do not have closing fees. I repeat, there are plenty that do not have fees. This means that when you refinance, you will not pay a cent! People will tell you these places don't exist. They're wrong. I have successfully done it twice and my friends/family/neighbors have as well. They exist, but many mortgage companies don't want you to know that other companies offer it. Either way, you can enter the closing cost fees in the zillow calculator (where we put 0 before) to see if it will still be a good tradeoff for you.

If you take the time and do your due diligence, you will find these companies. It's a win/win for you because not only will you get a low rate, you won't pay closing costs AND (bonus!) they will close it really fast. If they aren't charging you fees, they want to close it quick so they can resell your loan. That's how they make money off of your loan.

For example, I started refinancing my loan with a company that didn't charge closing costs. It sounded too good to be true, but after family members did it without hassle, I gave it a go. I got an extremely low rate (lower than the national average), had no closing costs, and it closed within 12 days.

A friend of mine was refinancing at the same time. I told her about the company charging no fees and giving me a better interest rate. She liked her mortgage broker and “trusted him” so she decided to refinance through him. She not only paid several thousand in closing costs, but her rate was 1.3 points higher than mine and took months to close which means she paid hundreds more each month while waiting instead of letting her refinance kick in right away. (P.S. 1 point is 1 percentage of the loan). By not shopping it out, she left hundreds of thousands of dollars on the table over the life of the loan. I get it though. You buy from who you like. That's understandable, but not when hundreds of thousands of dollars are involved. They have nice people at the “no-cost” companies as well. =)

Now, for the (minor) cons. If you find a mortgage loan company that refinances for no closing costs, your loan will likely be sold. In fact, it may be sold several times. While sometimes annoying, it honestly is no skin off my back for an amazing rate that saves me so much money. In fact, most likely, EVERY loan company will sell your loan, no matter what rate and closing costs they gave you. Therefore, there really is no “con” in my eyes.

3.) Someone you trust that can do a quick close.

Working with someone you trust is critical. These people are dealing with your financials and you don't want to be blindsided with hidden costs. Luckily, there are plenty of rules and regulations in place these days that don't allow them to operate like they did before the housing crisis in 2004.

You don't need to find a broker in your area that you can meet with in person. This is a new day and age. Time is money and you don't have time to meet with them in person. Handle everything over the phone. Fast, efficient, and easy.

My friend I mentioned above felt like she wanted to meet her broker in person. Well, she was able to do that, but also left hundreds of thousands of dollars on the table. Myself and all my family have done their loans via online and phone. It's a new day and age and that is normal. Plus, it allows you to shop it out and get the best rate. I trusted my original loan broker and my refinance broker. I found both of them online.

Also, a quick close is just a plus to get the action item off your list and out of your life! Plus, the quicker the close, the more money you'll save since you'll be saving money per month on the refinance. The quicker the better to start saving!

In summary, look for the Trifecta: A mortgage broker with no closing costs, a low interest rate, and someone you trust that can do a quick close! Hint: they're out there all over the US.

3.) Get the Payoff Statement from your Current Lender

Call you current lender and tell them you'd like a payoff statement. The payoff statement is a breakdown of the payoff fees you will be charged for refinancing your loan with another lender. (These are charges your new lender won't tell you about since they are not charges that come from them.) They're typically not that much, but make the call so that you have all information. Knowledge is power.

Also, ask them if they have a prepayment penalty.

You can include these costs in the zillow calculator under refinance fees since this is a fee you will incur. There's typically about 2-4 of them depending on your current lender's rules/regulations. It will usually end up being between $50-$300 in total with all costs. You may want to also ask for an emailed statement as well. If the fees still make refinancing a good option for you, then it's time to start the process.

4.) Submit an Application

Once you've decided on a lender with the “trifecta”, you will need to submit an application. This is where you will provide the documents you collected in step 1.

5.) Lock In Your Interest Rate

You will most likely have the choice of locking in your interest rate for a period of time. If you'd like to, you can lock it to protect you against any increase in rates.

6.) Underwriting and Appraisal

Your mortgage lender will now go through underwriting where they review the documents you submitted. At this time, they may also schedule an appraisal of your home. This is to make sure that your home is worth the value of the loan. Appraisals are sometimes not needed on certain properties like condominiums.

7.) Waiting Period

At this point, the lender is investigating you to make sure they want to take on your loan. You will just wait patiently until they are finished. This could be anywhere from a few days to 3 weeks. Feel free to ask them how long you should expect.

8.) Review the Closing Disclosure

After the lender has reviewed everything, they will provide you with a closing disclosure that will tell you the final numbers for your loan. Check everything with a fine toothed comb on this statement.

One thing that people are often hung up on is the fact that their new loan is more than their current loan. This is okay because interest is paid in arrears. This means that you actually owe one full month of interest to your current lender. Therefore, those charges will be added in to your new loan. This is not a penalty for refinancing. It's just money you owe no matter what.

Once you've read the closing disclosure and confirm it is correct, your lender will schedule the closing.

9.) Sign at the Closing

Here, you will meet with the notary for 60-90 minutes where you will sign off on the new loan. You will need to be prepared with:

- Valid ID

- Another form of ID (passport, social security card, etc)

- A cashier's check if you have closing costs

You'll sign off on the loan and you're DONE!

What to Look for After You Refinance

Now, just keep an eye on the mail over the 1-2 months as your loan will likely get sold to another company. (If you got a “no closing cost” loan then you can bet that it will definitely get sold.)

Just make sure you watch for any letters regarding the lender they are selling the loan to so that you know who to make your first payment with.

Hopefully this was helpful! Let me know if you have any questions and I'll do my best to answer them! =)

Related:

This website is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

Leave a Reply