One of the most important things you can do to accomplish your financial goals is to create a budget, track your expenses, and have a system to pay down your debt. Use this 13-page free printable expense tracker to stay on top of your budget and savings goals.

Keeping your finances organized is extremely important for your journey to financial freedom! Luckily, a budget tracker is extremely easy to implement and will keep you (and the family) accountable and on track for your goals!

My budgeting template will help you keep your monthly budgets and category expenses on track to help you achieve your financial goals while paying down debt.

In addition, this DIY budget binder includes 13 pages of financial tips or inspirational quotes on each page to keep you motivated!

To get your finances organized today, you can download my free 13-page monthly budget tracker! I'll explain exactly how to fill each page out in the post below!

This post is all about how to manage your money with my free printable expense tracker and downloadable budget binder.

Related Articles to Budgeting:

- Ultimate Guide to An Emergency Fund: Why You Need It with Free Emergency Fund Spreadsheet Download!

- How to Freeze Your Credit: A Financial Task You Need to Do ASAP

- What is a High Yield Savings Account (HYSA)?: Ultimate Guide

- Free Debt Payoff Printables: Exact Steps You Need to Know to Get Out of Debt FAST

- How to Make Your Own FREE Personal Finance Organizer

- Things To Buy at Dollar Tree: Ultimate List of 50+ Items that Will Save You Hundreds

- How to Track Your Net Worth: Ultimate Beginner’s Guide

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING THAT AS AN AMAZON ASSOCIATE, I MAY RECEIVE A SMALL COMMISSION AT NO COST TO YOU IF YOU DECIDE TO MAKE A QUALIFYING PURCHASE THROUGH MY LINKS. THIS HELPS ME RUN THIS SITE TO OFFER FREE CONTENT. THANK YOU SO MUCH FOR YOUR SUPPORT.

Monthly Budget Tracker FREE Printable

Ladies, if you aren't tracking your expenses, debt, and savings, you need to be today! In fact, if you don't have a high yield savings account, you probably should take a look at getting one today!

This is the easiest thing to do and will help you significantly on your journey to financial freedom and independence!

Since I truly believe it's so important, I created a FREE monthly budget tracker printable for you!

I'll go into detail on how to fill out every single page below, with examples.

But first, let's get you set up for success with all the things you'll need to be financially organized with your new binder.

How to Organize Your Budget Binder:

1.) First, print out all pages of the budget binder so that you're ready to go! You can download it here and then you will receive an email where you can print it straight from there! This is the printer I use to print out my printables. I absolutely love how chic and feminine it is (since printers can be so bulky and such an eyesore)!

2.) If you'd like to put all of the pages into a well-organized binder for easy reference, I'd recommend these feminine binders from Amazon. This way, you can carry it around with you or reference it each month easily!

3.) I also recommend getting both monthly and general dividers for your binder!

I label the general dividers in these categories:

- Monthly Expenses (this is where I put all of the monthly dividers January-December)

- Yearly Expenses

- Debt: Free Debt Payoff Printables: Exact Steps You Need to Know to Get Out of Debt FAST

- Goals: Want to Achieve Your Goals? Why Writing Them Down Will Make You More Likely

Below, I will dive into how to fill out each page of your new budget binder!

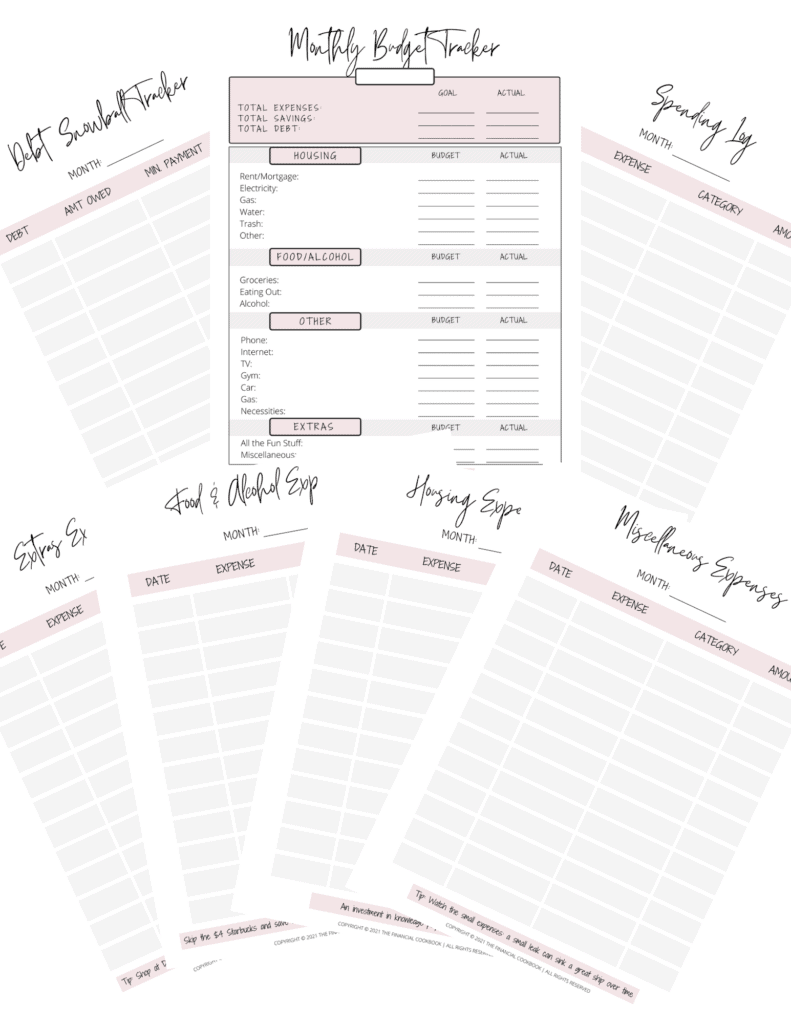

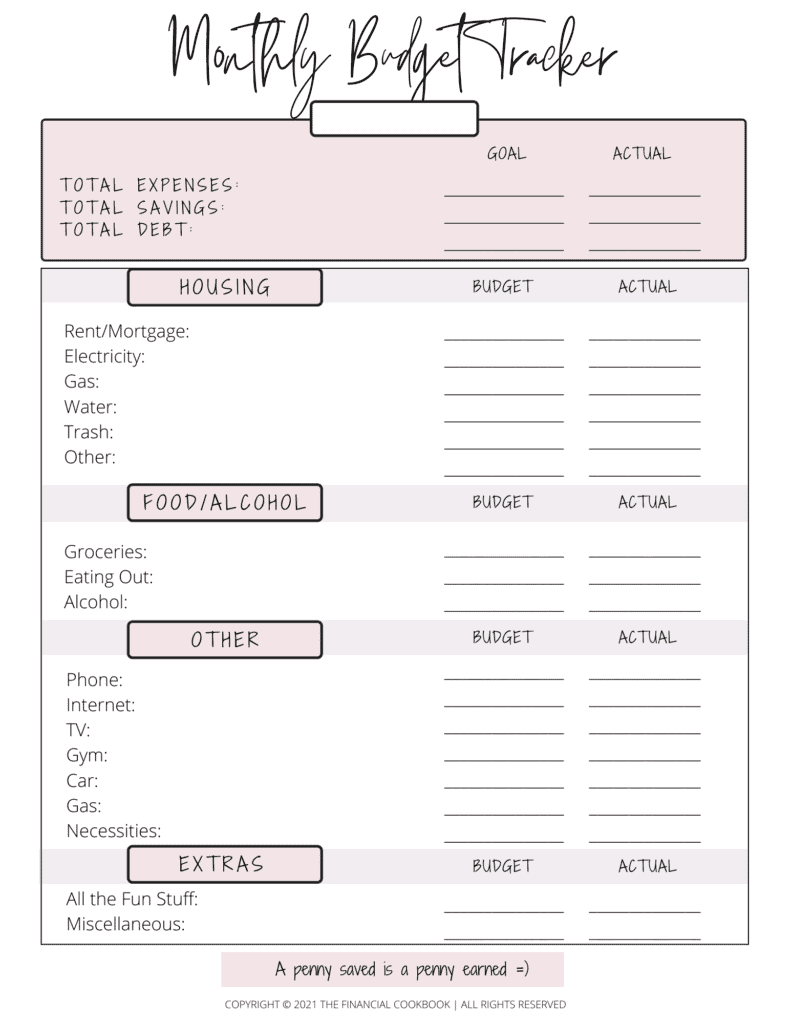

Monthly Budget Tracker Summary Page (Free Printable)

The first (and main) page is where you will log the summary totals of each individual category for the entire month.

Think of this as your “summary of the month” page.

I made sure to include all of the expenses that we, as ladies, purchase each month. (It's a lot, right?)

How to fill out the Monthly Budget Tracker Page:

1.) At the top, in the empty box, input the month.

2.) Next, enter your goals for expenses, savings, and debt.

3.) Enter your budgets in all categories.

4.) At the end of each month, you will add up all the expenses from your spending logs (in the next pages) and put the totals onto this page.

Example:

At the end of the month, I am going to add up all the totals from every spending log within each category. Let's say it's the month of January and I spent $250 on groceries.

1.) I'm going to go to the Groceries spending log (in pages below)

2.) I will add up the total expenses in Groceries ($250 total)

3.) I will write $250 under the Actual tab for Groceries in the Summary Monthly Budget Tracker below.

Make sense? I explain more below!

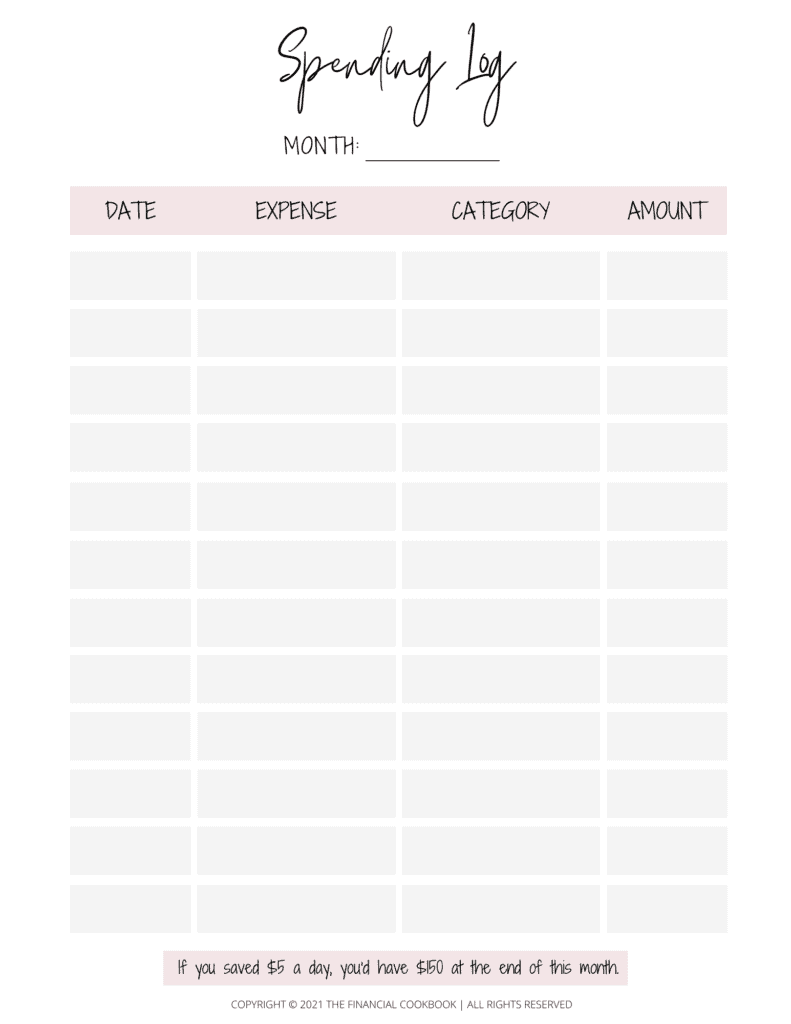

Spending Log (Free Printable)

The spending logs are where you will spend most of your time and where you will log each individual expense under the corresponding category.

This will help you to see patterns and trends in your spending.

This general spending log is for the girl who wants all of her expenses in one place and is fine with categorizing them on her own and maybe likes to use highlighters to dictate which category belongs to each expense easily.

You can choose to track all expenses on this general spending log, or use the category pages I discuss in the next section. (I included both options so that you can choose whatever is easiest for you!)

How to Fill Out the General Spending Log:

- Write in every expense you make. (Yes, every single one. This won't work if we aren't being honest with ourselves and tracking every single expense. The coffee counts!)

- Write in the corresponding expense category.

- Write in the amount.

Example:

If you buy a $10 lunch at Chipotle on 1.3.22, this is how you would enter the expense on the general spending log.

1.) Write the date (1.3.22)

2.) Write “Chipotle” under Expense

3.) Write “Food” under Category

4.) Write $10 under Amount

You with me still?

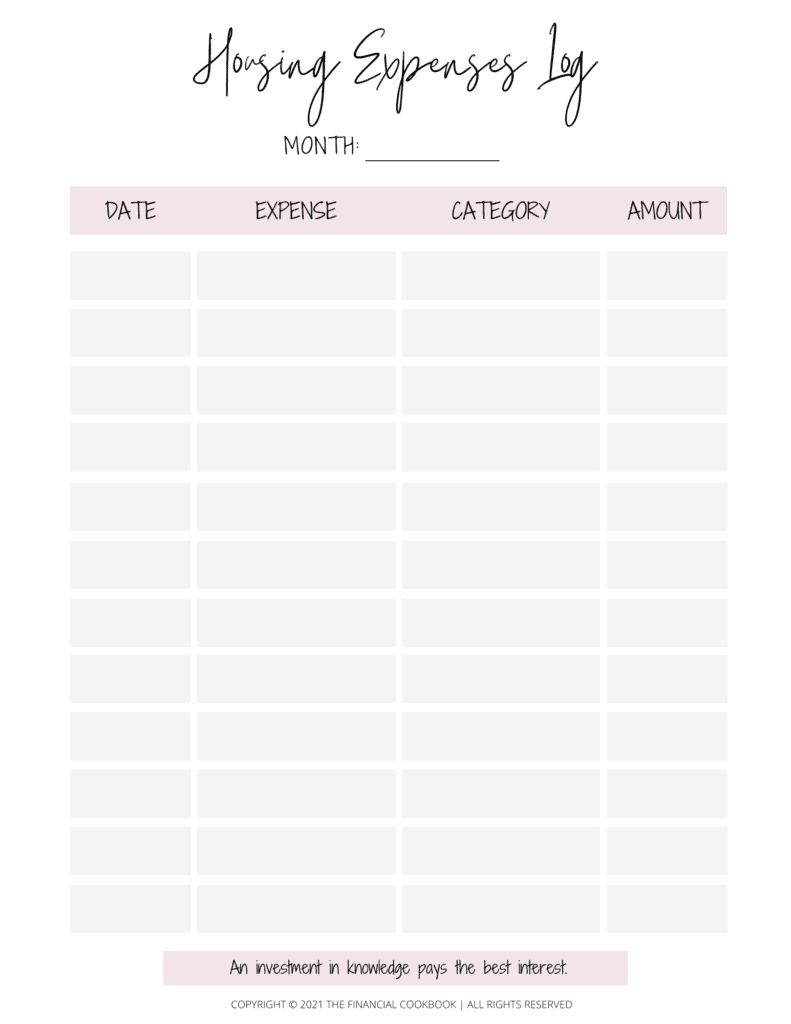

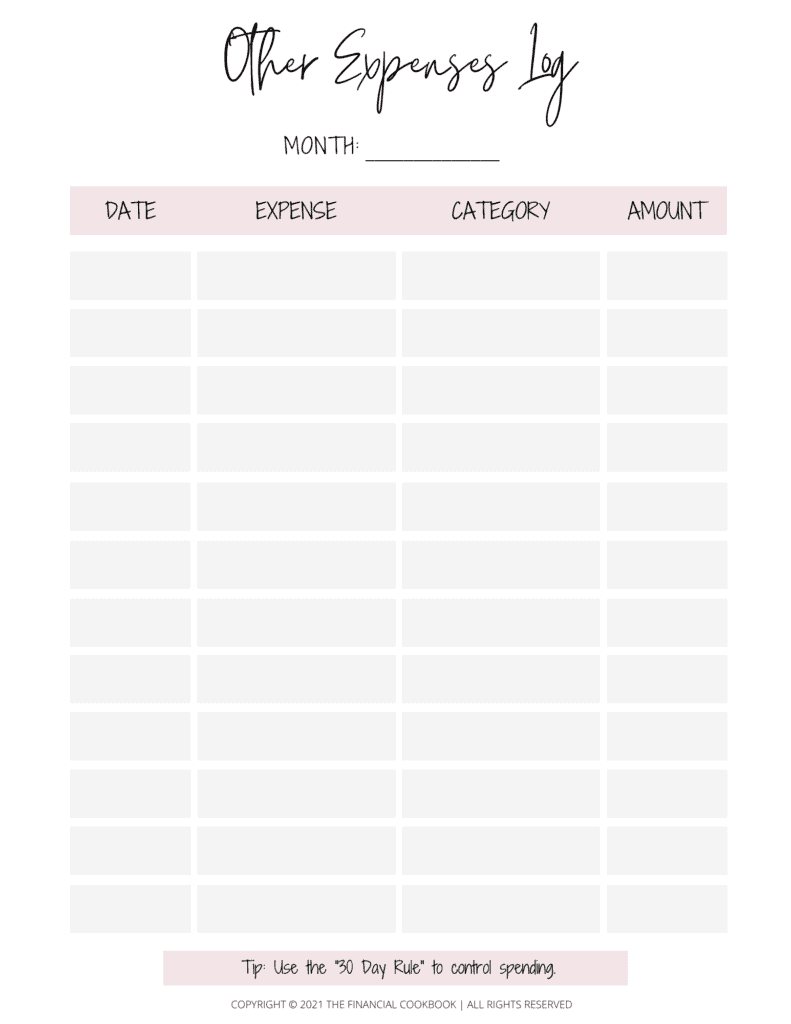

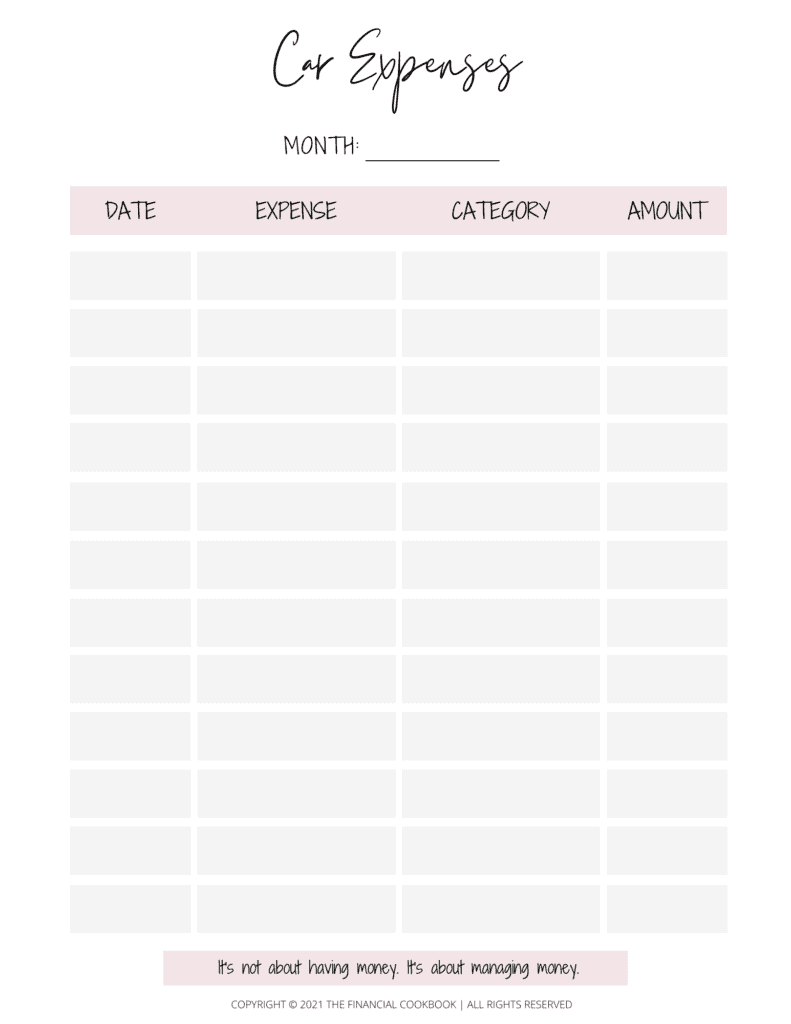

Category Spending Logs (Free Printable)

In addition to the General Spending Log above, for those ladies that want to divide their expenses into categories for easy summarizing, I have also included category pages for spending.

These would replace the General Spending Log we just discussed above.

Here are the Category Spending Logs and the associated expenses to add to those logs:

- Housing Expenses Log

- These are things like rent, electricity, gas, etc.

- Car Expenses Log

- This would include car payments, gas money, repairs/maintenance, etc.

- Other Monthly Expenses Log

- Examples: cell phone, gym, TV, gas and other necessities.

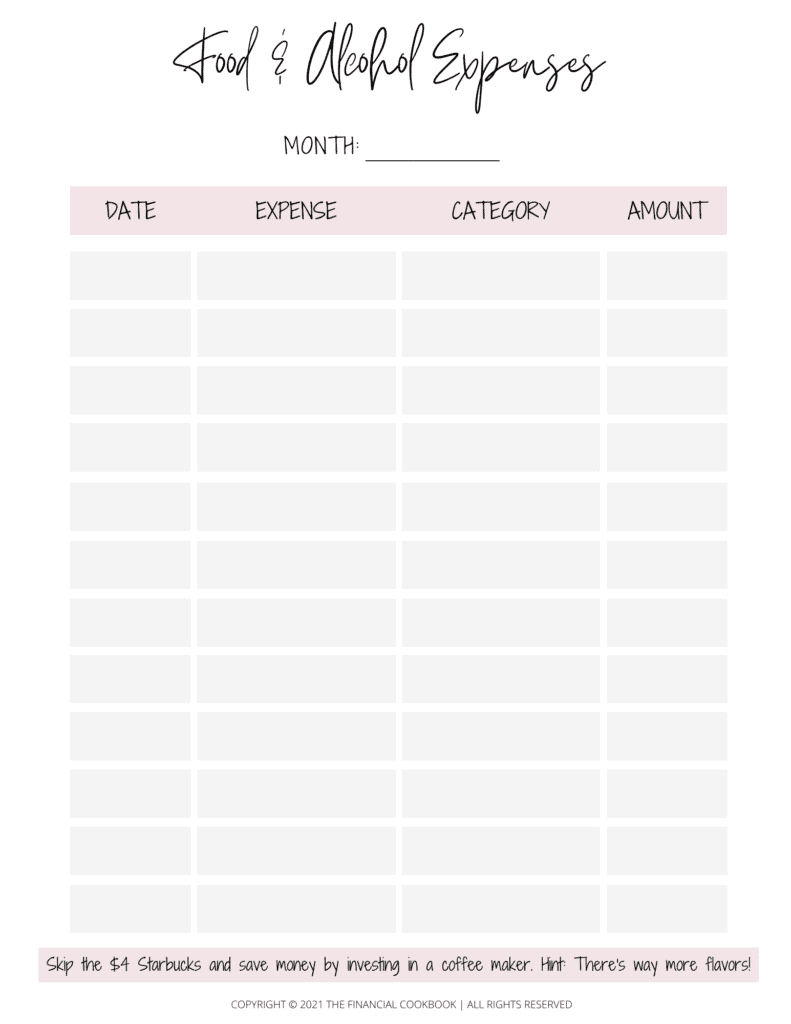

- Food/Alcohol Expenses Log

- Include groceries and eating out expenses.

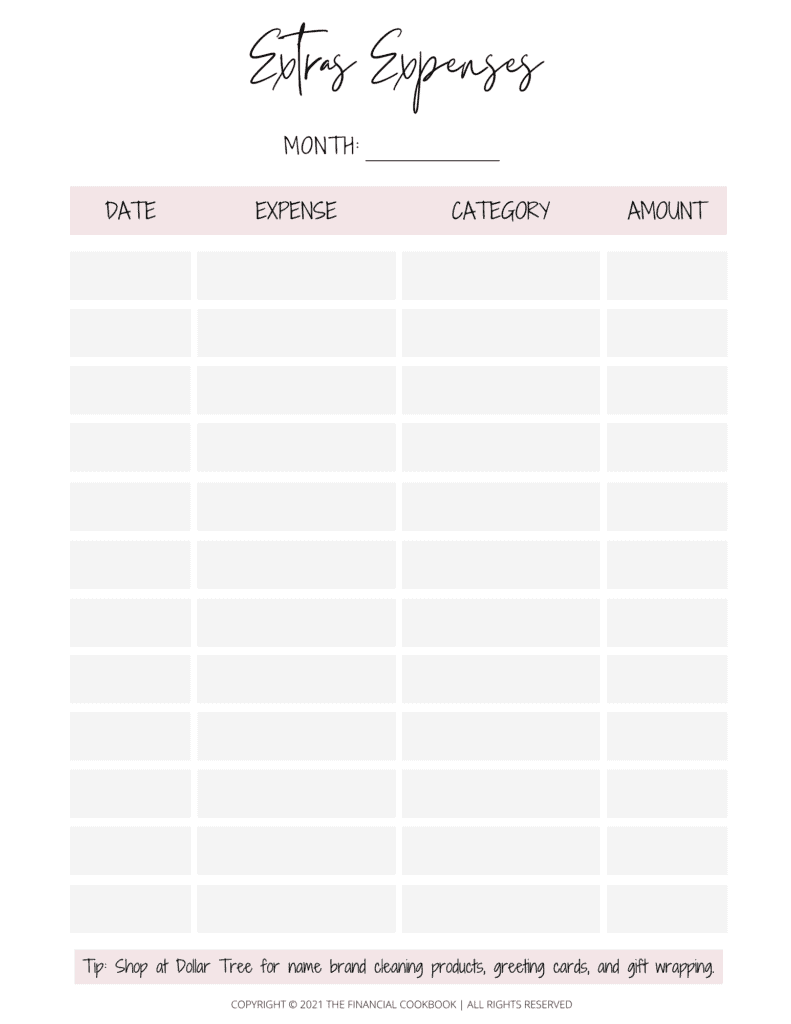

- Extras Expenses Log

- This category includes makeup, cleaning products for the house, hair cuts, toilet paper, paper towels, etc.

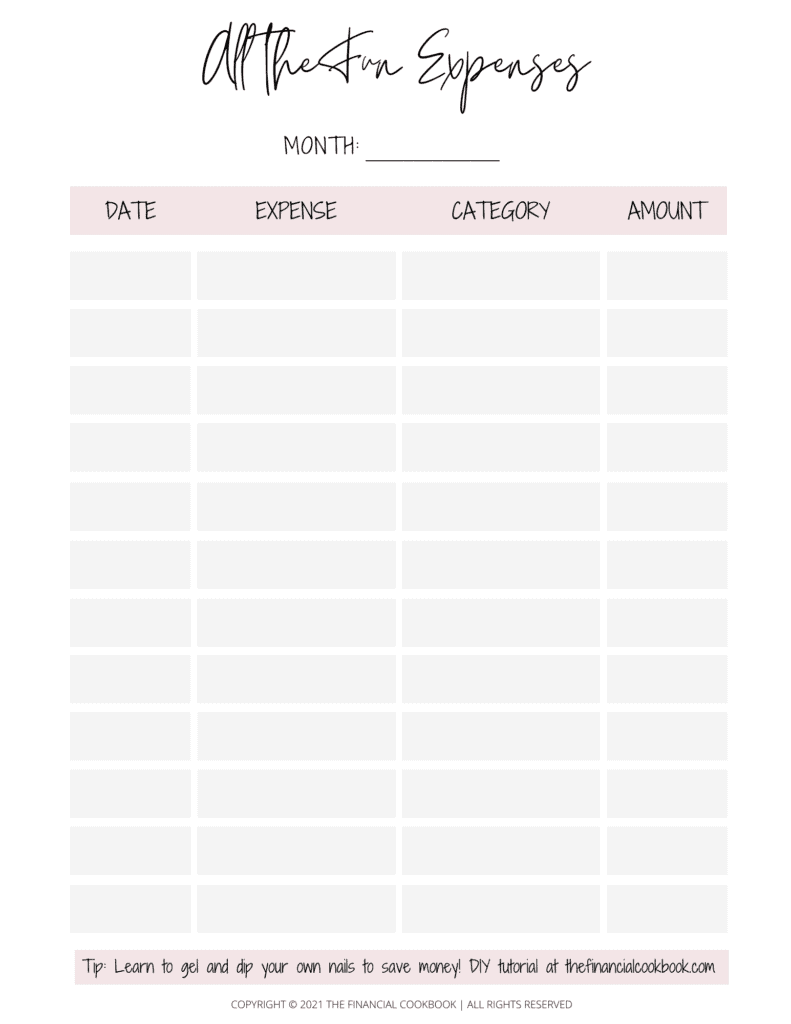

- All the Fun Expenses Log

- This name says it all. This is the category you will log getting your nails done, concerts, shopping, vacations and other non-essentials.

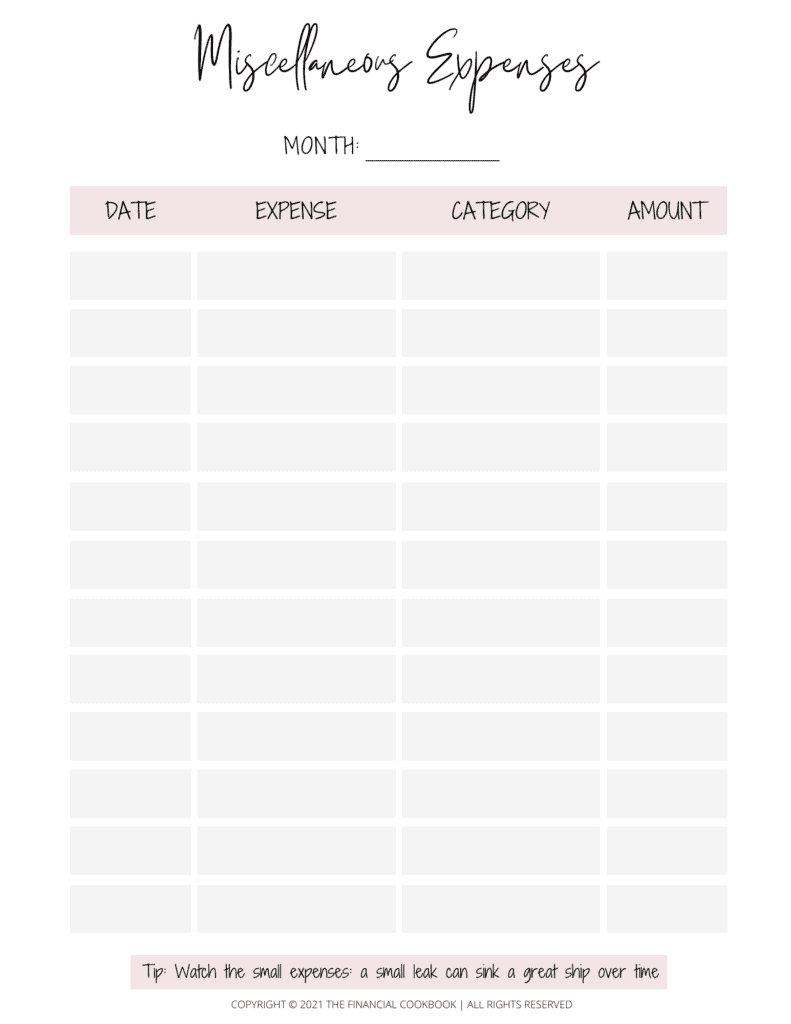

- Miscellaneous Expenses Log

- This category can be for whatever you'd like. However, I use it for unintended expenses like trips to the doctor, tolls, and other unavoidable expenses.

Feel free to use the category logs or the general spending log with highlights for easy summarizing at the end of the month! =)

Feel free to use highlighters to color code and make it even easier!

For example, I highlight all my alcohol purchases in blue so that I can easily summarize my alcohol spending. I LOVE highlighters!

In fact, I'm borderline obsessed. Here are the ones I use.

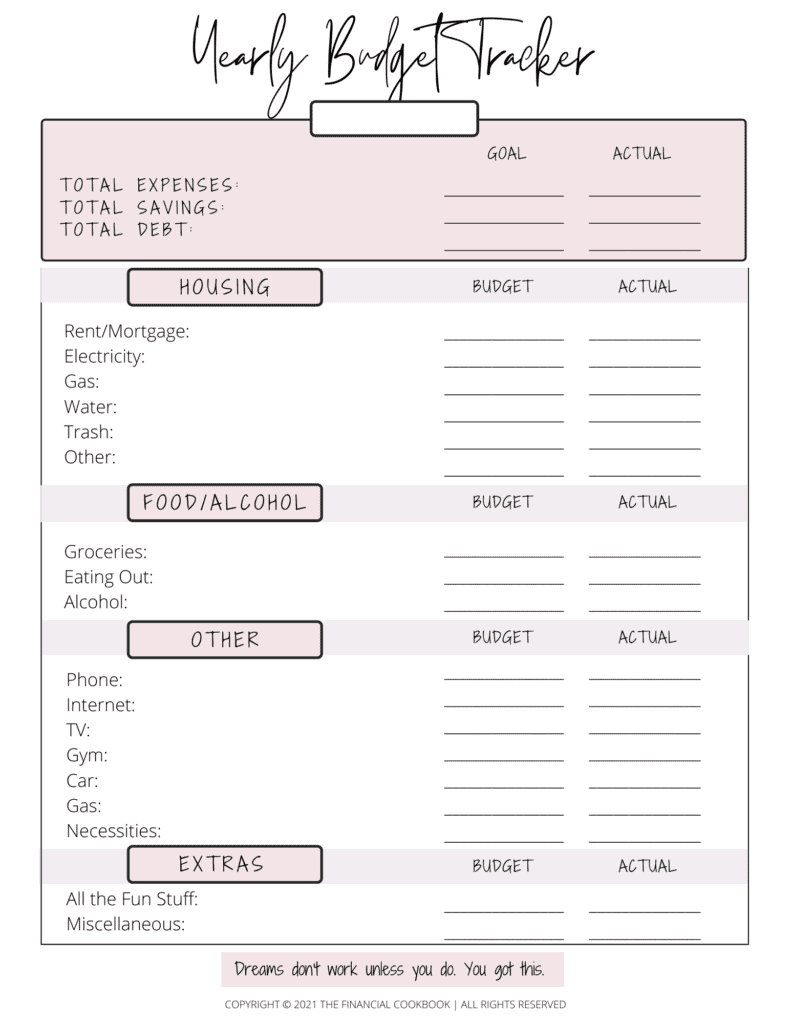

Yearly Budget Tracker Summary Page (Free Printable)

This yearly budget tracker page will look similar to the monthly tracker page, except it is a total of the entire year's expenses.

If you'd like to look for trends and aim to seek improvements in spending, I highly recommend using this page, to sum up your entire year.

This will help you identify where the majority of your expenses are coming from.

How to Fill Out the Yearly Budget Tracker:

1.) At the top of the sheet, in the empty box, input the year.

2.) At the end of the year, add up the expenses from the monthly totals pages to get your totals for the year! That will help you determine where you need to be more cautious when spending and will assist you in coming up with monthly goals going forward.

Here are more articles on budgeting you'll like:

- Ultimate Guide to An Emergency Fund: Why You Need It with Free Emergency Fund Spreadsheet Download!

- How to Freeze Your Credit: A Financial Task You Need to Do ASAP

- What is a High Yield Savings Account (HYSA)?: Ultimate Guide

- How to Track Your Net Worth: Ultimate Beginner’s Guide

- Free Debt Payoff Printables: Exact Steps You Need to Know to Get Out of Debt FAST

- How to Make Your Own FREE Personal Finance Organizer

- Things To Buy at Dollar Tree: Ultimate List of 50+ Items that Will Save You Hundreds

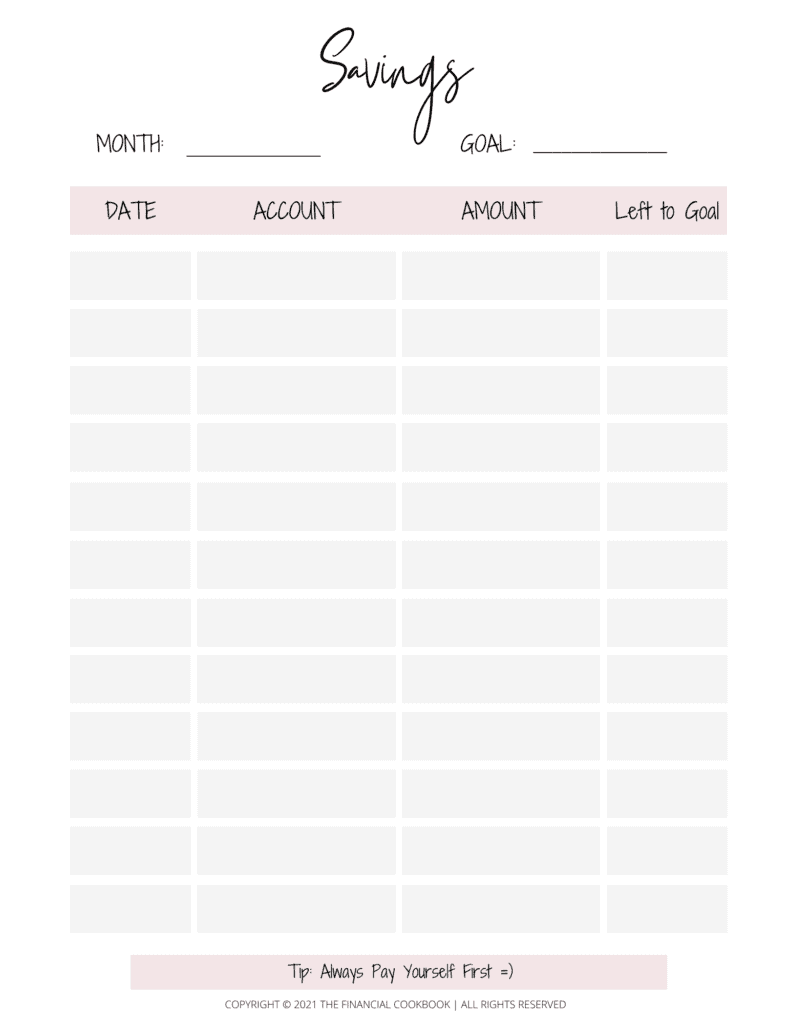

Savings Tracker (Free Printable)

The savings tracker is where you will keep track of how much money you have saved.

How to Fill out the Savings Tracker:

1.) In the savings tracker, enter the amount every time you make a deposit into your bank account.

2.) This will tell you how much you have left to your savings goal!

Remember, try to always pay yourself first! Use whatever is left over for expenses!

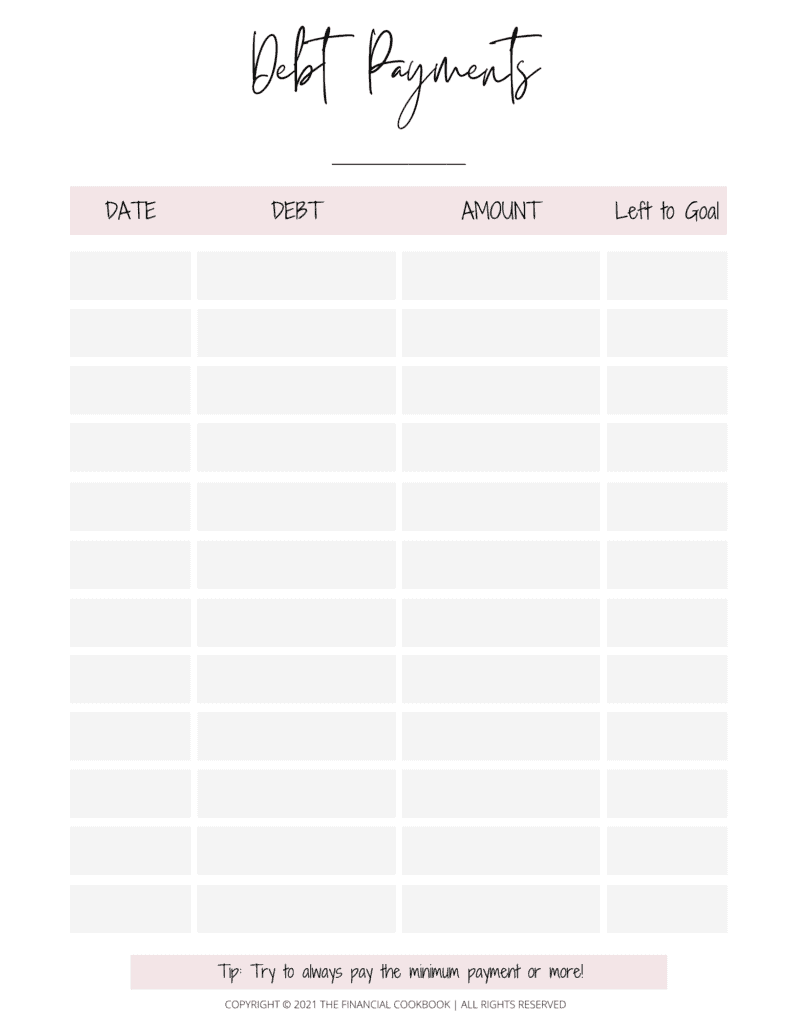

Debt Payment Tracker (Free Printable)

Did you know that according to studies from Bankrate, the average American debt in 2021 was $92,727? Let's change that. Debt is a huge problem in this country and we need to work to eliminate it, one by one!

This simple debt tracker page enables you to track the payments you make on your outstanding debt.

You can either use this tracker on a monthly basis or you can keep a running log for the year. I purposely left it open so that you can choose whether or not you'd like to track your debt payments on a monthly or yearly log.

I left the line open so that you can either enter the month or the year!

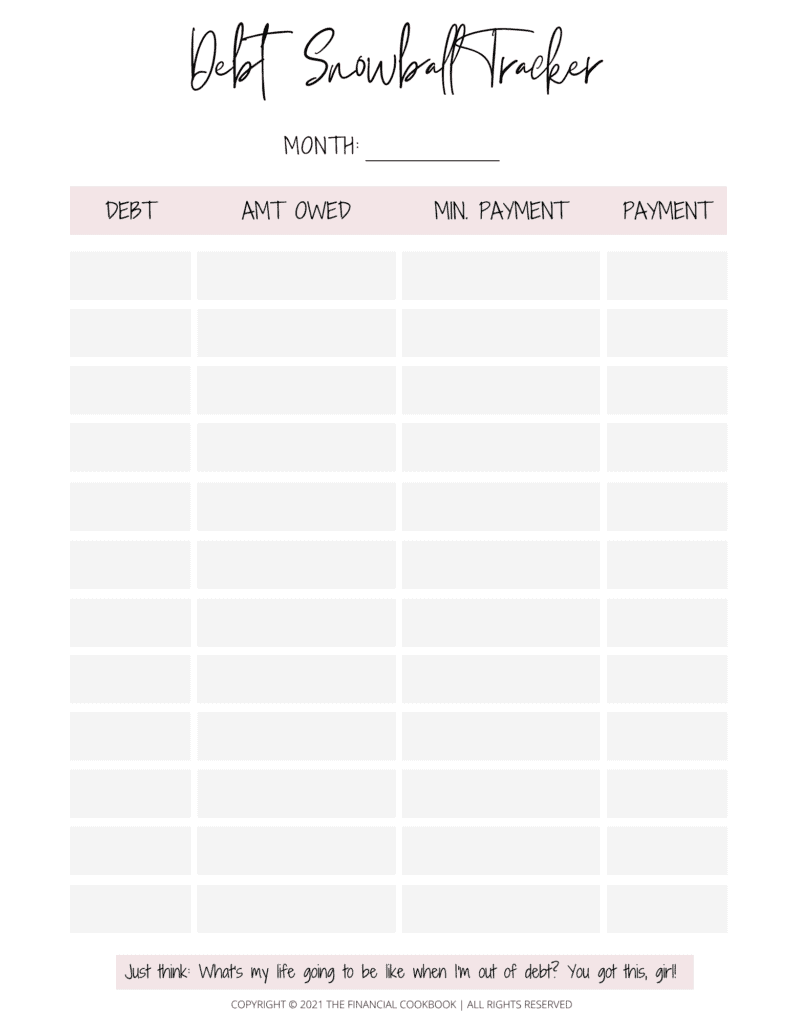

Debt Snowball Tracker (Free Printable)

The debt snowball tracker is an effective (and proven) method to track and eliminate your debt.

The purpose of the debt snowball tracker is to keep us accountable for paying our minimum payments on each debt while making progress in paying down our debts.

In the snowball method (vs the avalanche method), you will pay down your debt from the largest amount to the smallest amount.

I explain how to use the debt snowball method below.

How to Use the Debt Snowball Tracker:

- List your debts from largest to smallest in the tracker.

- Next, each month, pay the minimum amounts on every debt you have.

- Any leftover money each month should be assigned to the smallest amount of debt you have. This way, you can attack the easiest debt first and eliminate the number of debts you owe as quickly as possible.

- Once you pay off the smallest debt, you will take the minimum payment from that debt and apply it to the next debt in line.

- You will continue doing this until all of your debts are fully paid off.

The idea behind this method is that you will have little wins by eliminating each debt at a time.

The debt snowball tracker is an amazing method that truly works and gives us a proven strategy to conquer our debt one step at a time.

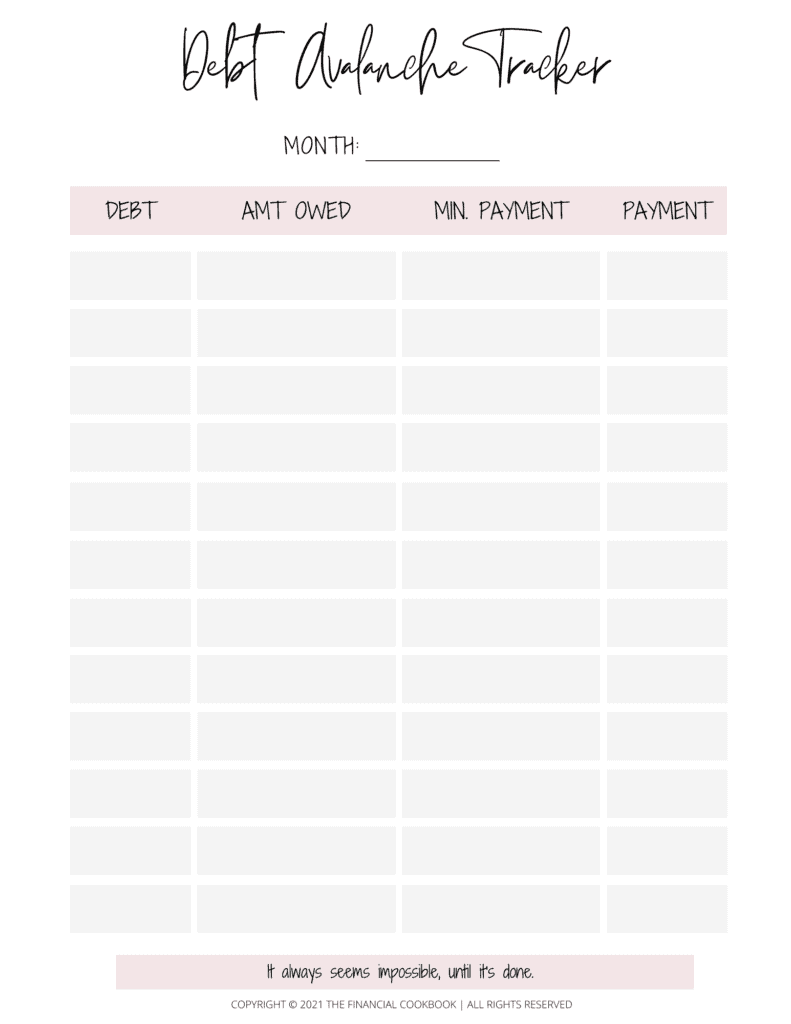

Debt Avalanche Tracker (Free Printable)

The debt avalanche tracker is my favorite way of eliminating debt.

In this method, you will eliminate debt by the highest interest owed to the lowest interest owed. This method will save you the most amount of money in the long run.

For more information on both debt payoff methods, visit this post.

How to Use the Debt Avalanche Tracker:

- List your debts from largest % of interest to smallest % of interest in the tracker.

- Every month, pay the minimum amounts on every debt you have.

- Any leftover money each month should be assigned to the next debt in line with the highest % of interest. This way, you can attack the most expensive debt first and save the most amount of money.

- Once you pay off the highest interest debt, you will take the minimum payment from that debt and apply it to the next highest interest debt in line.

- You will continue doing this until all of your debts are fully paid off.

The idea behind this method is that you will save the most amount of money by reducing your high-interest debt first.

Budget Binder Summary

Congratulations!

You have now taken the first step to financial independence and that is SO EXCITING!!! You should be SO proud of yourself for taking the initiative and taking control of what you want most in life!

I believe in you. You've got this! We have a plan together. Now let's go CRUSH it!

Related Posts about Budgeting

- Ultimate Guide to An Emergency Fund: Why You Need It with Free Emergency Fund Spreadsheet Download!

- How to Track Your Net Worth: Ultimate Beginner’s Guide

- What is a High Yield Savings Account (HYSA)?: Ultimate Guide

- Free Debt Payoff Printables: Exact Steps You Need to Know to Get Out of Debt FAST

- How to Freeze Your Credit: A Financial Task You Need to Do ASAP

- How to Make Your Own FREE Personal Finance Organizer

- Things To Buy at Dollar Tree: Ultimate List of 50+ Items that Will Save You Hundreds

Resources to Help with Budgeting

Get a High Yield Savings Account with Axos Bank

The average interest rate you make at a normal savings bank is .05%. However, a high yield savings bank will make you up to 16X more in interest! This is one of those no-brainers, free money, “everyone should be doing” decisions. Keep in mind that the interest rates will continuously change. The interest rates will vary, but right now they are about .5%. It's super easy to start an account and I highly recommend it to all of my clients as everyone should have a high yield savings account for money needed in the next 5 years (like a house) and for your emergency funds.

Sign Up for Truebill

Truebill will save 80% of people money, according to their website. They will find all of your subscriptions and cancel them for you, based on the green light from you. Most people don't realize what subscriptions they have so Truebill will take the guesswork out of it for you and get them canceled to put more money back into your bank account and streamline your spending. (FREE Download)

Have Trim Negotiate Your Bills

Trim offers such a unique service and is one of the best financial tools to take advantage of. They actually negotiate your bills down for you and help you save so much money. Does your internet bill go up after the “promotional deal” is over? Trim will take care of that negotiation for you so that you don't have to spend hours on the phone! (FREE Download)

None of the links will take me to the printables.

Hi Kristi, when you click on the link, it will open up another page where you’ll put in your email address and it will send to you via email. =) if you’re still having issues, email me at thefinancialcookbook@gmail.com and I will send to you manually. =)

Hello! I have tried to download the expense log and binder contents as well and despite entering in my name and email twice I have not received anything and have checked my spam folder too. 🙁

Hi Hannah, i’m so sorry for the trouble! Did you end up receiving the file? I can send it to you manually if there’s an issue with receiving it!!