Want to start your journey to financial freedom?

Start with my favorite financial tools!

I've put together a list of the best (and mostly free) tools to save money, make money, and invest money!

THIS POST MAY CONTAIN AFFILIATE LINKS. THIS MEANS THAT IF YOU MAKE A PURCHASE THROUGH MY LINKS, I WILL RECEIVE A SMALL COMMISSION AT NO EXTRA COST TO YOU. ALL OPINIONS ARE MY OWN.

LEARN

Financial Cookbook Newsletter

A monthly newsletter with all the “recipes for success” for women on careers, real estate, saving money, making money, and investing money straight to your inbox. I'll also break down money tools and discounts to assist you on your journey to financial freedom! Let's conquer our goals together! (FREE Newsletter)

Credit Monitoring Service

I highly recommend some sort of credit monitoring service and I personally use TransUnion. I can't even describe how this has helped me! They have a free version, but I recommend paying the low monthly cost for such a high reward. They will track your credit score so that you can check it at any time, but also email you every time there's a change in your credit. This means you are informed if there is any kind of fraudulent behavior on your account so you can take care of it right away. There's nothing worse than going to get a credit card or home and being denied because someone had opened a credit card in your name and now your credit is ruined. Be proactive and get some sort of monitoring service. The peace of mind is so worth it!

PLAN

22 Money Steps to Level Up Your Finances

Try these 22 money management steps to get your finances in order this year! These steps have helped hundreds of thousands of women stay on track financially and prepare mentally for their goals!

Empower

This is one of the best financial tools for money management. By linking your accounts in one place, Empower will help you get on track for retirement and manage your money effectively by providing insights to help you achieve your financial goals! You will also be able to track your overall net worth. (FREE Download)

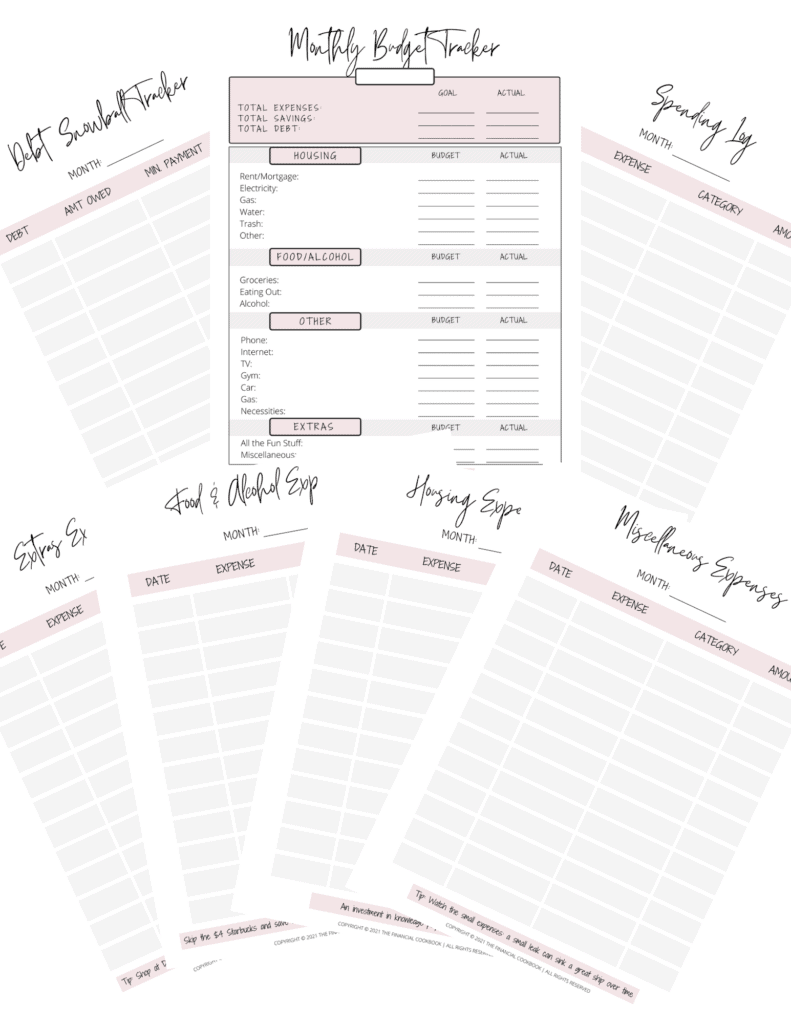

Budget Tracker

To plan for your financial goals, track your expenses, and start the proven strategy to pay down your debt quickly, use this free budget tracker. This free 11-page printable document will help you stay accountable, identify trends in your purchasing to watch, and will assist in attacking your debt to help you reach financial freedom. Plus, it includes uplifting tips and tricks for motivation! (FREE Download)

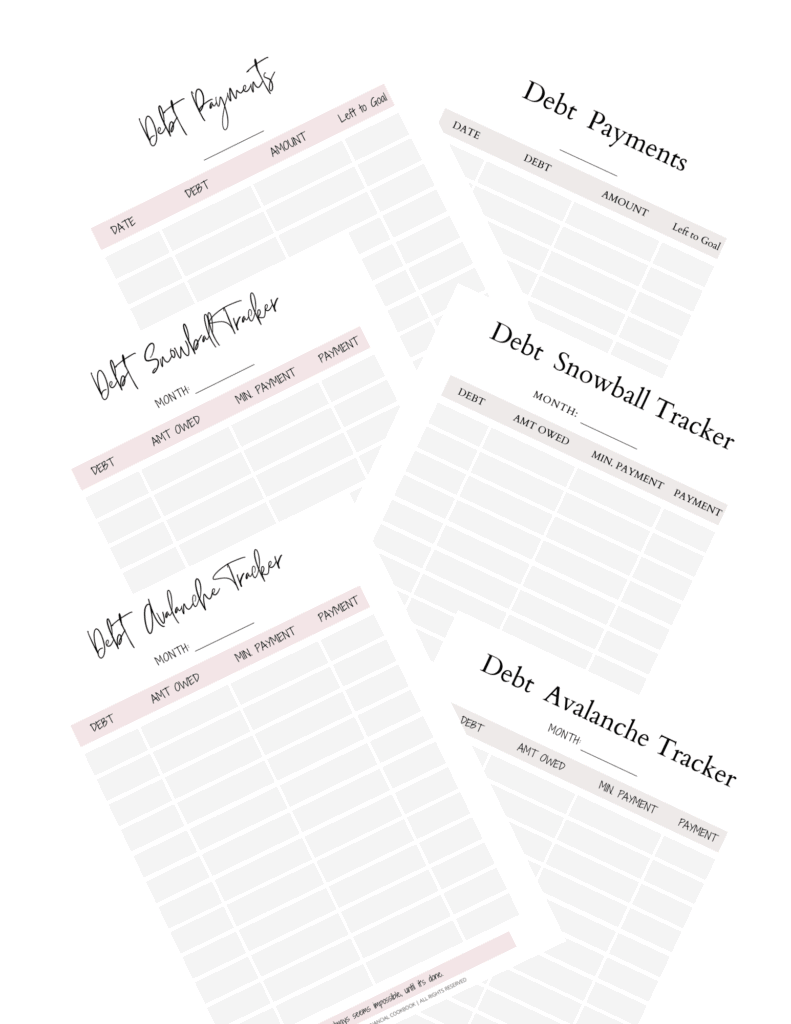

Debt Payoff Tracker

If you have debt you're trying to pay off, these debt payoff trackers will help you conquer it to achieve financial freedom! There are two debt payoff methods I recommend: Snowball or Avalanche. I explain both methods and walk you through exactly how to do it efficiently to pay off your debt in a quick amount of time. (FREE Download)

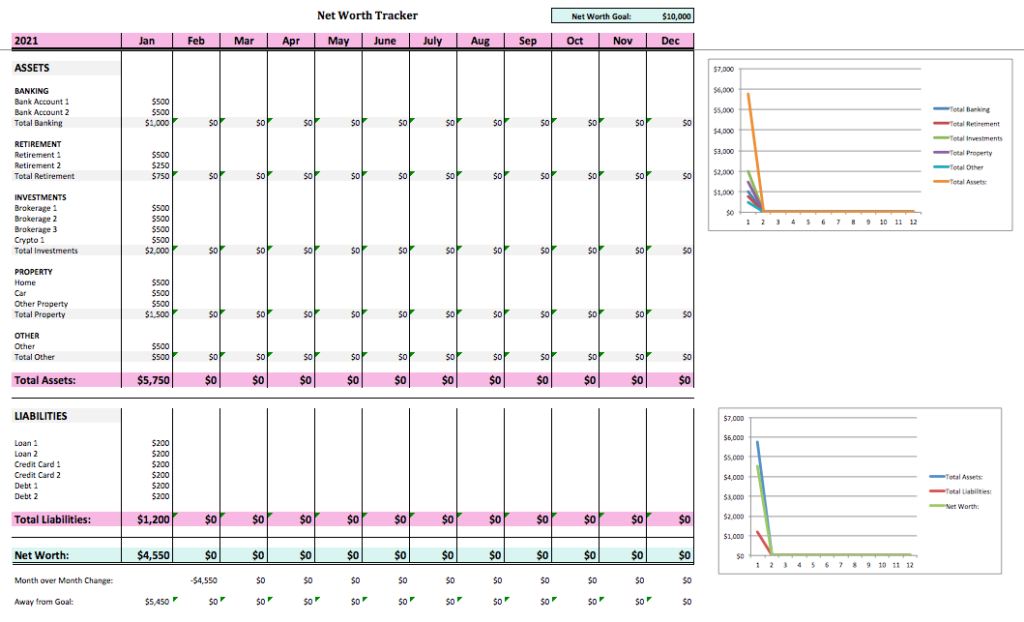

Net Worth Tracker Spreadsheet

Tracking your net worth is one of the best things you can do to stay on target with your financial goals. Set a money date with yourself every month (I do it on the 1st) and go through all of your assets and liabilities. This will allow you to set goals for yourself and analyze where you're at in your retirement plan. I actually get excited every month when I get to go through my net worth spreadsheet. You will too! (FREE Download)

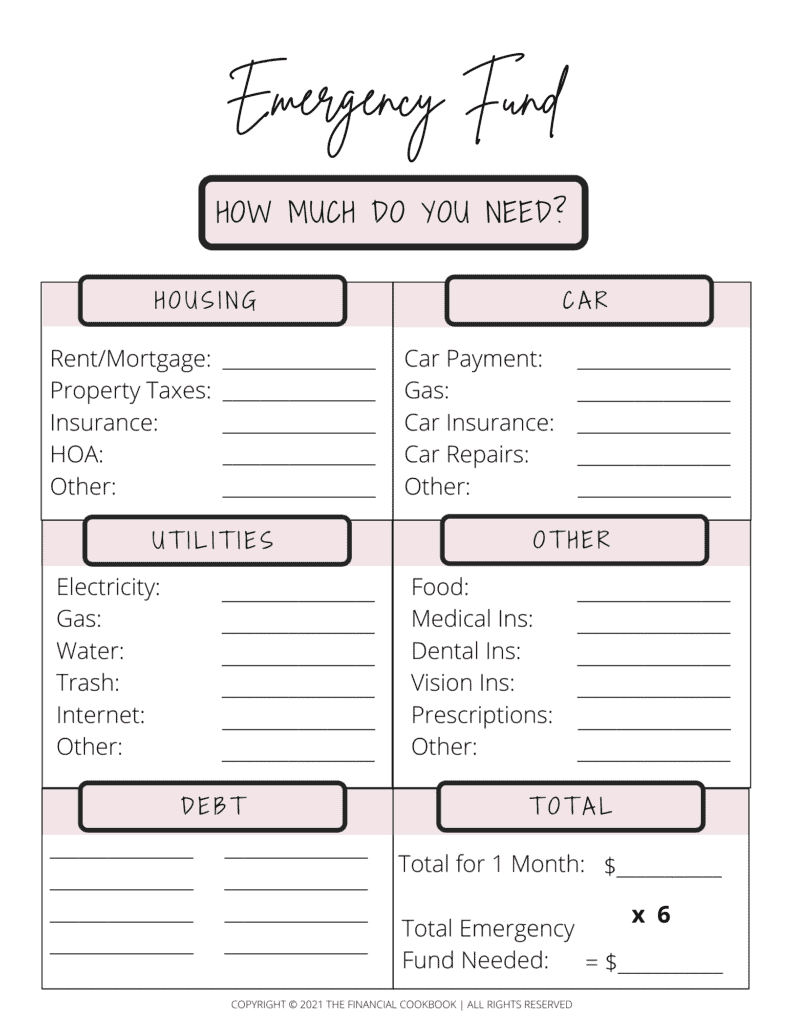

Emergency Fund Spreadsheet

Every single person should have an emergency fund set aside for unexpected expenses like job loss, medical bills, home/car repairs, etc. Use this free emergency fund spreadsheet to discover exactly how much you should have in your emergency fund. It comes with a “how-to” guide and additional essential information. (FREE Download)

SAVE MONEY

Axos Bank (High Yield Savings Account)

The average interest rate you make at a normal savings bank is .05%. However, a high-yield savings bank will make you up to 16X more in interest! This is one of those no-brainers, free money, “everyone should be doing” decisions. Keep in mind that the interest rates will continuously change. Pre-COVID, the rates were around 1.75%. Now they are .5%. They continuously change with the market so it's nothing to be worried about. It's super easy to start an account and I highly recommend it to all of my clients as everyone should have a high yield savings account for money needed in the next 5 years (like a house) and for your emergency funds. See my ultimate guide to high yield savings accounts here.(FREE)

Rocket Money (Formerly Truebill)

Rocket Money will save 80% of people money, according to their website. They will find all of your subscriptions and cancel them for you after you review and give them the green light. Most people don't realize what subscriptions they have so Rocket Money will take the guesswork out of it for you and get them canceled to put more money back into your bank account and streamline your spending. (FREE Download)

Mint Mobile

Mint Mobile is a fantastic way to save money while still receiving the same great cell phone service you have today! They are redefining the cell phone space and in doing so, they charge a fraction of what you are paying with the big box cell phone carriers. Take a look at the amazing cost savings you can achieve by switching to Mint Mobile today!

Cook Unity

Cook Unity is one of my absolute favorite ways to save money on food. Instead of going out to eat and spending a fortune, I keep Cook Unity meals in my freezer for those nights where I don't have time to cook and want to stay healthy. These have been an absolute lifesaver in helping me stay on track with my nutrition while watching my budget! I eat paleo so I pick my meals based on the paleo category. They are fantastic and make my life so much easier! After all, time is money!

Ibotta

Ibotta is a different type of cashback site where you get a rebate back for your purchases after the fact. You simply upload your receipt from their participating stores, which includes grocery stores, gas stations, and liquor stores, etc! They offer rebates for different items all the time and support stores like Walmart, Ulta, and Home Depot! Ibotta has paid out over $682 million to its users to date! That's amazing! They offer different promotions upon signing up! (FREE)

MAKE MONEY

Rakuten

Rakuten is the cashback site I use to actually get cashback for my normal purchases. Y'all, I used to completely stay away from these types of things. However, I ONLY recommend things I use and LOVE Rakuten! I make about 5%-10% back from my normal purchases at Target, Macy's, Nordstrom Rack, etc. They have over 2,000 participating retails! This is FREE Money, people! Plus, they are giving $30 to my readers just for signing up here! That’s a no-brainer! Starbucks money, anyone? Here's my honest review on Rakuten. (FREE)

Fundrise: Real Estate Investing for Beginners

Fundrise is an amazing opportunity to make passive income by investing in real estate for as little as $100! Many people want to get into real estate, but don't have the down payment. If you're one of those people or just want an investment that makes rental income, Fundrise could be a great choice for you! This is an endorsement in partnership with Fundrise. We earn a commission from partner links on thefinancialcookbook.com. All opinions are my own.

Top Cash Back

Top Cash Back's claim to fame is that they are the “most generous” cashback site in the USA! They are a free app that offers rebates and coupons for over 4,000 retailers! It's completely free to use and will give you cashback on qualifying purchases. For example, they were offering 11% off on Macy's last week. I spent $100 so I am now receiving a check for $11 from TopCashBack. It's super simple so I check both Rakuten and TopCashBack every time I make a purchase at a retailer to see if there's any money I'm leaving on the table. (FREE)

Swagbucks

Swagbucks is a survey site that pays you to take surveys online! You take the surveys in your spare time and watch the dollars rack up in your account. They are offering my readers a $5 bonus when you sign up to start making extra cash by taking surveys online! (FREE Download)

INVEST

Robinhood– Brokerage for Beginners

This is my favorite stock trading platform for beginners. The platform was the first to offer no-commission trades and is free to sign up and use. Their app shows stocks in real-time and is extremely easy to use. I actually use my Robinhood app every single day multiple times a day. In fact, it's the first and last thing I do every morning and night. It’s that easy! Here's my beginner's tutorial on how to use the Robinhood app. My readers will receive a FREE STOCK upon sign up. (FREE)

M1 Finance– Robo Advisor

M1 Finance is a brokerage account that serves as a Robo Advisor. Instead of paying a financial advisor a lot of money, they have automatic investments set up for you based on a questionnaire and goals you provide. Here, you'll plan for retirement and gain long-term wealth. They'll help you decide your financial plan based on risk factors, goals, etc. Not only will you invest your money long-term with M1, but you can also do several other things. You can open an IRA, establish a joint account for marriage, purchase fractional shares, and get a better understanding of your financial plan. Like Robinhood, they also don't have fees! Huge bonus! (FREE)

Acorns-Loose Change Investing

Acorns is an interesting app because it automates investing for you in a whole different way. It allows you to invest your spare change by simply “rounding up” your purchases. You can also set up recurring investments like you would with any other brokerage. It offers a simplistic platform and provides beginner coaching on investing. It's a perfect app for a beginner investor and someone that struggles with budgeting. My readers will receive $10 for signing up with my link.

Vint– Wine Investing

Vint is the first wine investing platform. Yes, you read that right. You can actually invest in wine through this platform. In fact, you can own shares of some of the best wines in the world. Did you know that investments in wine actually outpace art, bonds, and other investments? Who knew? I love new and interesting investment opportunities and this one certainly fits the bill! Learn more about how Vint works in this post.

Blooom- Retirement Planning

Blooom makes retirement planning simple. Through Blooom, you can link all of your existing accounts and let them give you insight on what you're doing well and assist on things you are unsure about. They will provide insights and action items to help you get to where you want to be at retirement.

Personal Fund Cost Calculator

This is a free financial tool to check the costs of individual mutual funds and index funds. It will put together a report for you of all the fees you are paying (or will pay) in that fund. You can also set up a comparison between one fund and another fund. I absolutely love this tool and I'm surprised nobody talks about it. It saved me from paying hundreds of thousands in the future so I'm grateful I caught the hidden fees of my funds ahead of time.

CALCULATE

Job Comparison Tool

This job comparison tool will help you decide between two jobs. You can compare the details of your current job versus the new job offer to make an educated decision on which job to choose! Don't forget the additional benefits as well!

Compound Interest Calculator

A compound interest calculator will help you determine how much your money will be worth in a specified number of years based on the investments you make now. My favorite one to use is below.

Mortgage Calculator

Considering buying a home? This tool will be your new best friend. A mortgage calculator will help you determine exactly how much your payments will be on the mortgage for your new home.

Amortization Calculator

This calculator will help you determine how much you will pay in interest over the life of the loan. It will also show you how much of your monthly mortgage payments will go to interest and principal each year. It's very helpful in determining the cost of homeownership.

Home Refinance Calculator

A home refinance calculator is such an amazing tool when determining if you should refinance. This calculator helped me realize I could save $300 a month from refinancing. The next day, I refinanced. It's a game-changer!

For the tools and plugins I use for this website, visit Blogging Tools