Having an emergency fund is essential to be prepared for unexpected expenses. Let's dive into what an emergency fund is, why it's important, and how much you need. Plus, download the free spreadsheet!

If you don't have an emergency fund, listen up! This post is for you. Every single person should have an emergency fund.

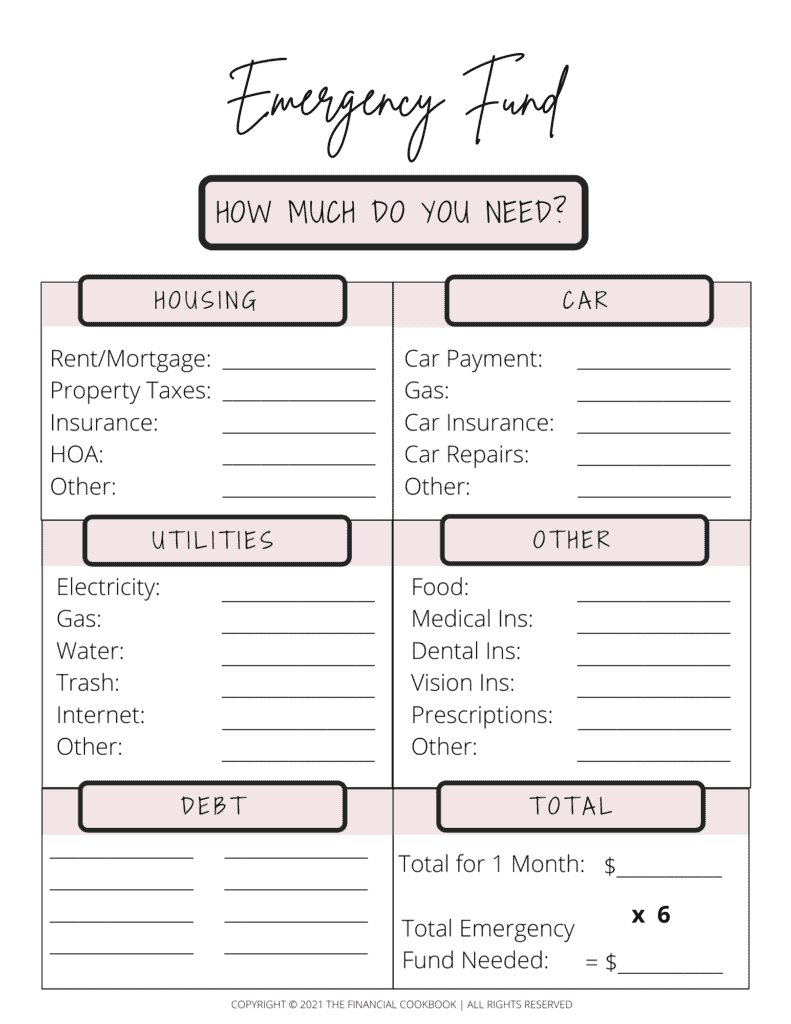

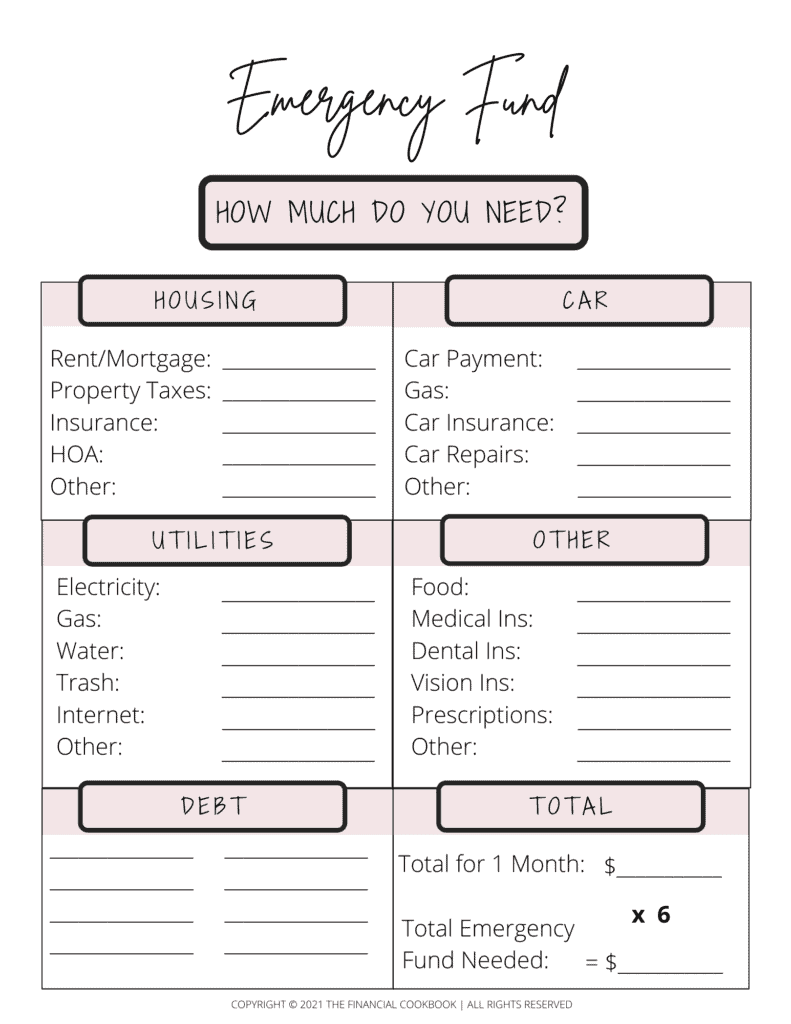

Feel free to download my Emergency Fund Spreadsheet Printable for easy calculation. (It's Free) I'll explain how to fill it out below!

Let's get started!

Related Articles:

- FREE Printable Expense Tracker: Downloadable Budget Binder

- 5 Things to Look for In a High Yield Savings Account

- Top Financial Tools

- Financial Cookbook Easy to Understand Financial Definitions

Articles on Saving Money:

- Eco-Friendly Ways to Save Money: Ultimate List

- How to Do Dip Nails PERFECTLY at Home to Save $1,000 a Year

- 9 Money Saving Tips to Increase Your Savings Immediately

What is an Emergency Fund?

An emergency fund is money set aside that is ONLY touched in case of emergency.

Possible emergencies may include a job loss, car or home repair, unexpected health, family or pet expenses, etc.

This is money you will keep in case things hit the fan and you need money quick! You do not take it out for any other reason.

Why is an Emergency Fund Important?

An emergency fund is extremely important to have and every single person needs to have one.

Life happens. Things happen in life. We never expect bad stuff to happen, but it does.

Ever broke your arm? That bill is around $50,000! Good thing I had health insurance! However, I still had to pay my deductible of almost $2,000. YIKES! Didn't expect that bill…

Side Note: If you don't have health insurance, you need it to get it…like…YESTERDAY.

I'm not kidding.

I can't even tell you how many people's lives are forever turned upside down due to the occurrence of a medical emergency when they didn't have health insurance. One of my friends was $175,000 in debt at the age of 21 simply because she wanted to save on the cost of health insurance each month.

Don't be stupid. Sorry to put it bluntly. Health insurance is expensive, but it will PROTECT YOU FROM FUTURE COSTS! Trust me. You'll thank me later.

The truth is, we can't predict what will happen in our lives. Unexpected expenses come up all the time.

One time, my friend's dog ate a cellophane bag of chocolate truffles… $7,000 in vet bills later, the dog is fine, but her bank account is not.

She didn't have an emergency fund so guess what she did? Put it on a credit card.

Now, she's not only paying the $7,000 in vet bills, she's paying the credit card company interest on that money! Plus, her credit score is affected and all of her other plans for the year.

We don't want that. Let's plan now to avoid headaches later.

Where Do You Keep an Emergency Fund?

This is a FANTASTIC question.

Savings bank or checking account? NOPE!

I don't recommend keeping your emergency fund in a general savings/checking account.

Why?

General savings and checking accounts make little to no interest on your money.

Since this money is just sitting there and will stay there for (hopefully) a long time, you'll want to make sure you get at least SOME interest on it.

Instead, I recommend you start a High Yield Savings Account.

High Yield Savings Account

This is where you should keep your emergency fund (and any money you'll need in the next 5 years).

These are online savings banks that give you 10-16x the interest that a savings/checking account will!

There's no catch and no hidden fees.

In fact, I'd say it's one of the best kept secrets that shouldn't be a secret. This is one of those no brainer free money things that everyone should be doing.

The caveat is that you just can't walk into a physical bank and speak to a teller…But who does that anyway?

The interest rate you get will fluctuate and continuously change based on how the overall economy is doing. The Federal Reserve determines the federal funds rates. When those rates go up, your high yield savings rate will go up (and vice versa).

For example: Last year, the HYSA interest rate was around 1.75% APY. Now, it's about .45% APY. It will fluctuate based on the actions of the Federal Reserve in response to the economy. Either way, some interest is better than no interest.

The High Yield Savings Account I recommend is below:

It’s super easy to start an account and I highly recommend it to all of my clients as everyone should have a high yield savings account for money needed in the next 5 years (like a house) and for your emergency funds. (It's Free)

How Long Do I Need to Save For?

I always recommend saving for 6 months. I'll help you figure out exactly how much money that is below.

If you're really tight on cash, you can start with 3 months.

However, make it your goal to keep 6 months in savings.

If you can save enough for 1 year of expenses, you get a gold star!! I personally save for at least a year of unexpected expenses, but I also plan to use that money for 5 year goals (like more real estate).

How Much Do I Need to Save?

Alright, so let's figure out exactly how much you need to save in your emergency fund.

You can use my free printable emergency fund calculator to determine those exact figures. I'll explain how to fill it out in the steps below!

Step 1: Fill Out Each Category

Go through each category on the spreadsheet and fill in the MONTHLY dollar amounts needed to cover each expense. If you don't have the expense listed, YAHOO!! Leave it blank or put “0”.

- Housing

- Rent/Mortgage

- Property Taxes

- Home Insurance

- HOA (if you have it)

- Other: This could be for home repairs (if you're a home owner)

- Car

- Car Payments

- Gas for Car

- Car Insurance

- Car Repairs

- Utilities

- Electricity

- Gas

- Water

- Trash

- Internet (may be excluded as well if it's not a necessity)

- Food

- I recommend budgeting for groceries, not going out. If you're in a money crunch, you shouldn't be going out until you get back on your feet.

- Medical

- Health Insurance

- Dental Insurance

- Vision Insurance

- Prescriptions

- Vet Insurance

- Other

- Pet expenses

- Gym is optional. I leave it off because I can always work out at home. I'll leave that up to you since maintaining physical health even during financially rough times is still very important.

- Debt

- List all of your debts in the left hand column.

- List all of your minimum monthly payments in the right hand column.

I left “other” lines for additional expenses you may have in each category.

Netflix, Hulu, other TV, etc are not to be included in your emergency fund. You can cut those things in case of an emergency.

Step 2: Add Up Totals for One Month

Take another look and make sure you've accounted for everything.

Now add up the totals of all of your expenses and write it in the “Total for 1 Month” area in the lower right hand corner.

Step 3: Multiply by 6

I recommend preparing for 6 months, but if you feel more comfortable with 3 for now, I'll allow it.

However, you should aim for a 6 month emergency fund down the road.

Write the total amount it gives you in the bottom right hand line that says “Total Emergency Fund Needed”.

Emergency Funds Summarized

There you have it! You now know exactly how much money to have saved in case of an emergency.

If you don't have that saved in your bank account today, that is your first goal. Your second goal for this week is to open a high yield savings account. They're free to open and you'll want to start earning interest on that money.

If you have that amount saved, but it's in a savings/checking account, your goal today is to open a high yield savings account to start making interest on that money.

Please let me know if you have any questions! You're now on the road to financial independence! I'll help you get there!

Related Articles:

- FREE Printable Expense Tracker: Downloadable Budget Binder

- 5 Things to Look for In a High Yield Savings Account

- Money Tools

- Financial Cookbook Easy to Understand Financial Definitions

Articles on Saving Money:

This website is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

Leave a Reply