This free personal finance organizer will help you create a plan to get out of debt, budget effectively, and achieve financial freedom.

This post will teach you how to build your own free personal finance organizer. In this printable binder, you will be able to track all elements of your finances and goals to achieve them via strategies that are proven to work. By the end of this post, you'll have a specific plan to follow and an adorable finance planner that will help you achieve your goals to start living your dreams!

Having a financial organizer is extremely important to accomplishing your financial goals for accountability and responsibility. I used the strategies in these printables myself to get out of debt fast, budget with ease, and achieve my financial goals!

The idea behind The Financial Cookbook is that I give all the recipes to success so I think of this financial planner as your Financial Cookbook for success.

Since this personal financial organizer was so effective for me, I decided to make them available to my readers for free, in the hope that you'll find success as well!

I hope they help you in your financial journey!

This post is all about a free personal finance organizer every woman should have to help her reach financial freedom to start living her dreams!

DIY Free Personal Finance Organizer

There are several elements I've created for your personal finance organizer. Depending on your situation, you can print the elements that would be most helpful for your journey.

Below, I have laid out each of the elements, the goals of each element, and the links that give full descriptions on how to fill them out, download them, print them, etc!

First, what do you need to create your own personal finance organizer? These are the 3 key things you'll need!

What You Need for Your Organizer

1. Printer

The first thing you'll need is a printer. Since my personal finance organizer will come to you in printable form, you'll need to open the PDFs and print them!

You most likely already have a printer or have access to one, but if you don't, the one above is one I'd recommend! I have that one in my office and love it!! It's cheap, it's high tech, it is able to do color (most of the printables have color) and it does all the things you need!

2. Binder (Cute preferable =)

You'll need a binder to put all of your printables into. Make sure you love the binder since you'll be using it every day for your expenses! The binders above are super cute and classy!

Make sure you also grab a 3 hole puncher if you don't have one already!

3. Dividers

In my personal financial planner, I have blank tabs for all the different categories. This helps me easily stay organized.

I also have monthly tabs so that I can put the expense tracker logs within each month, along with the monthly budget trackers. This way, everything is easy to find and navigate. I also keep all pages so I can refer back to them at the end of the year.

Okay, let's get started with the meat and potatoes of what will go in the binder!

How to Create Your Own Financial Planner

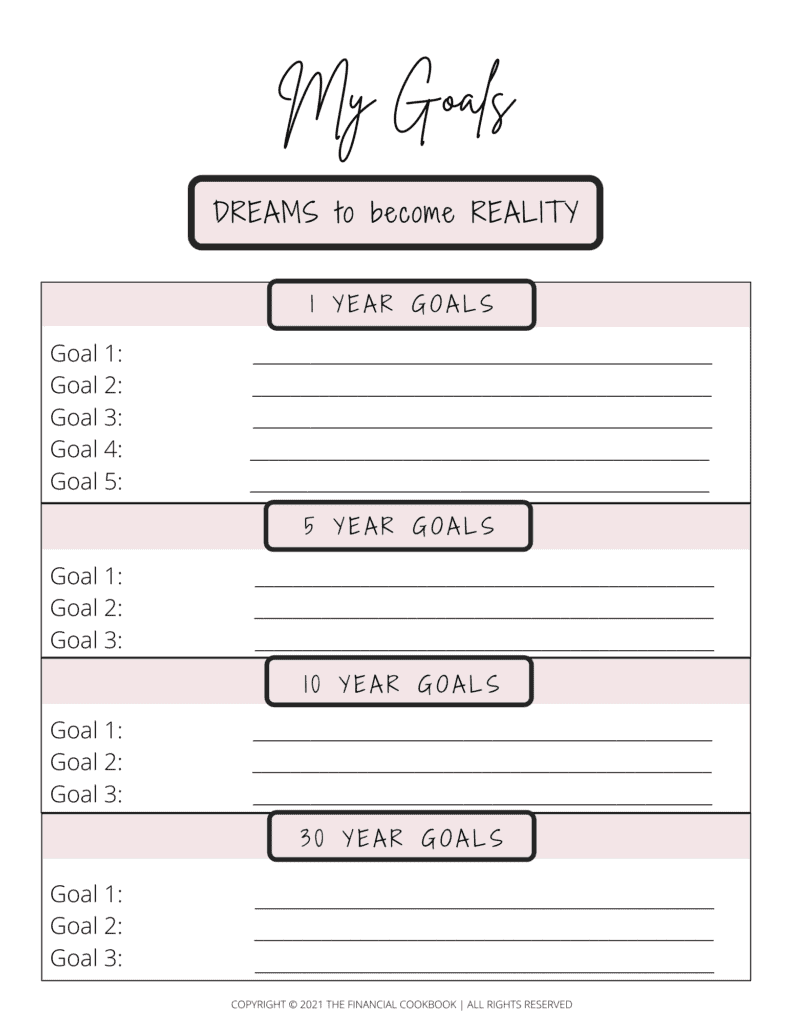

1. Goal Tracker

The first thing you'll want to put in your binder under the first tab is the Goal Tracker. The goal tracker will allow you to really think about what your dreams are so that you can work backward to achieve them.

They say people are much more likely to accomplish their goals if they have them written down.

Go ahead and take the time to fill this one out and make sure to look ahead to your 30 year goals as well! For some of year, 30 years could be your retirement year. For others, 30 years could be right before retirement.

Either way, it's important that we thoroughly understand short and long-term goals. Otherwise, what motivation would we have to achieve something we don't know we want, right?

I'd also recommend creating a vision board to include under this tab. I always have a vision board and it's actually extremely rewarding to go back and look at the things I dreamed about, that I now have. I'd almost say it's more rewarding to see that you put your mind to it and did it than actually achieving whatever it is!

You can download the goal tracker here.

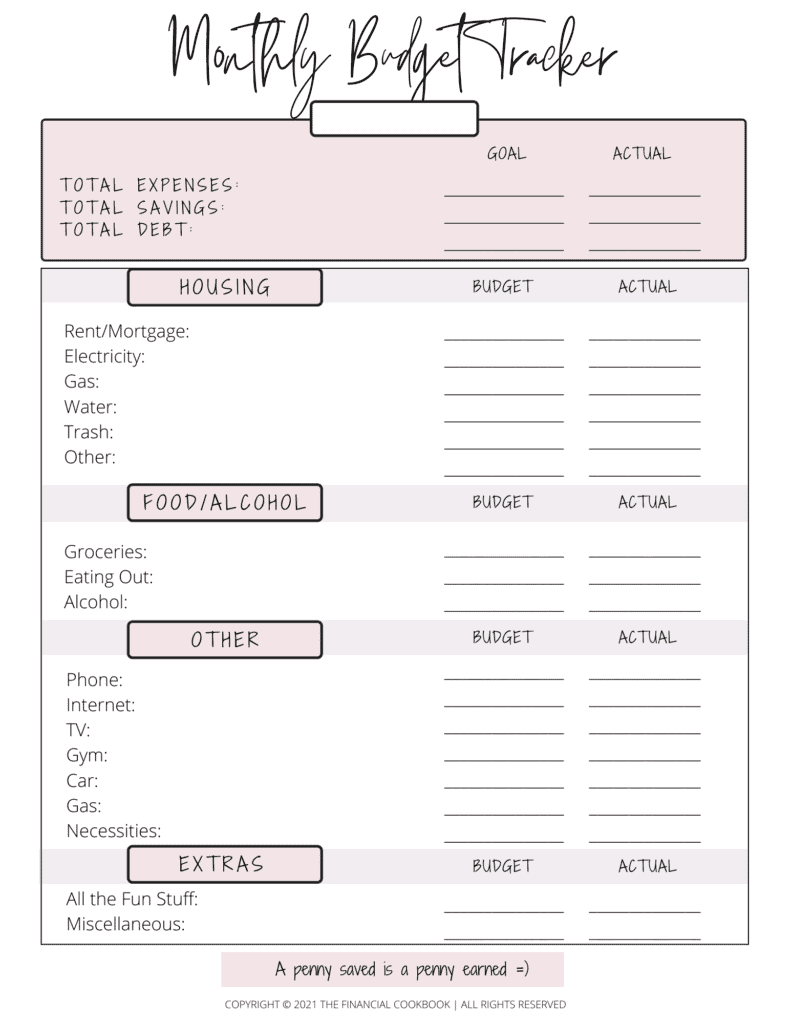

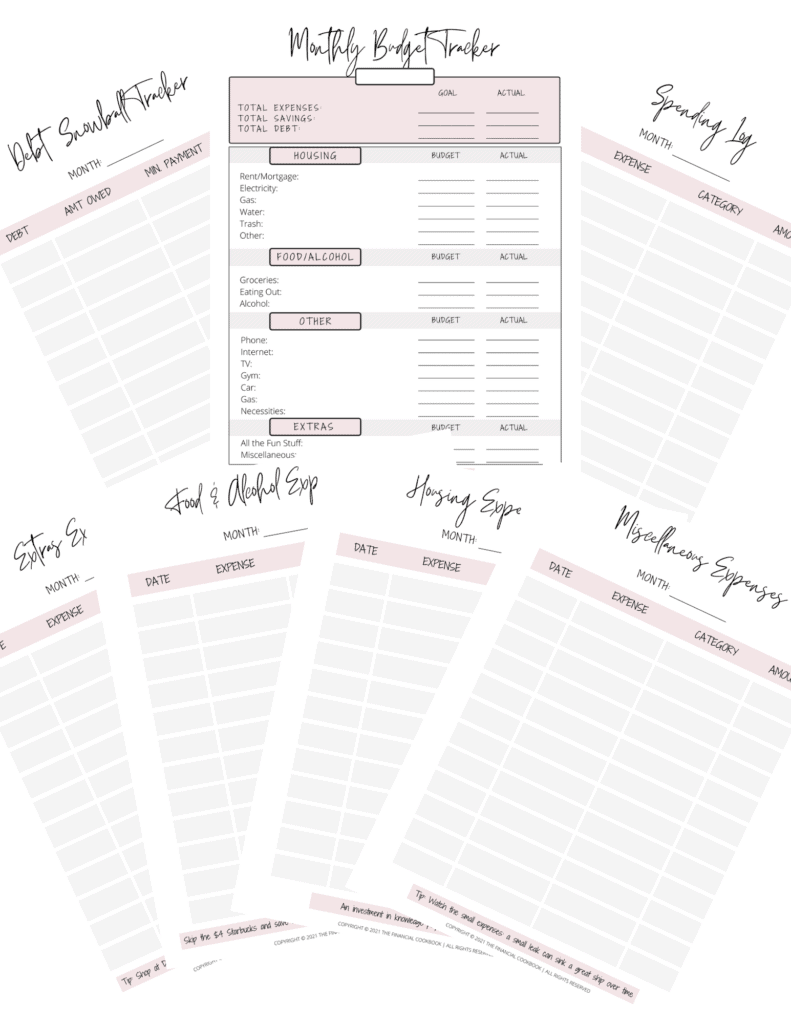

2. Monthly Budget and Expense Trackers

The next tab you'll want to have is your monthly budget tracker.

This is where you'll put the monthly white tabs we talked about. Under each month, you'll print out the monthly budget tracker to track your budgeting goals and totals for the month.

Here, you will enter your budgets for the month under every category and you'll put what you actually spent at the end of the month to see how you did!

This monthly budget tracker is used by thousands of women and truly will help you stay on track with your finances, if you stick to it.

I challenge you to come up with a budgeting goal for yourself and actually stick to it! In fact, if you stick to it, tag me with a picture and I'll feature you on Instagram! =)

You can read all directions on exactly how to fill it out and download the budget tracker by going here.

In the next element, we will discuss how to track those expenses.

Related Posts on Saving Money:

- 8 Unique Ways to Save Money as a College Student

- 9 Money Saving Tips to Increase Your Savings Immediately

- Things To Buy at Dollar Tree: Ultimate List of 50+ Items that Will Save You Hundreds

- Eco-Friendly Ways to Save Money: Ultimate List

3. Expense Logs

If you downloaded the budget tracker above, you'll have the expense logs in that file as well. In fact, it's 13 pages of budget tracking tools!

Under each month, print out all of the pages so that you have everything for budgeting within every month. Print out as many pages as you need.

You will enter every expense you incur over the month into the expense spending logs. I divided them into categories for easy math at the end of the month or you can use the standard logs as well!

This is the easiest way to track your expenses and you can print out as many as you need!

You can download the full expense log trackers here (if you already downloaded #2, you already have them in your email!)

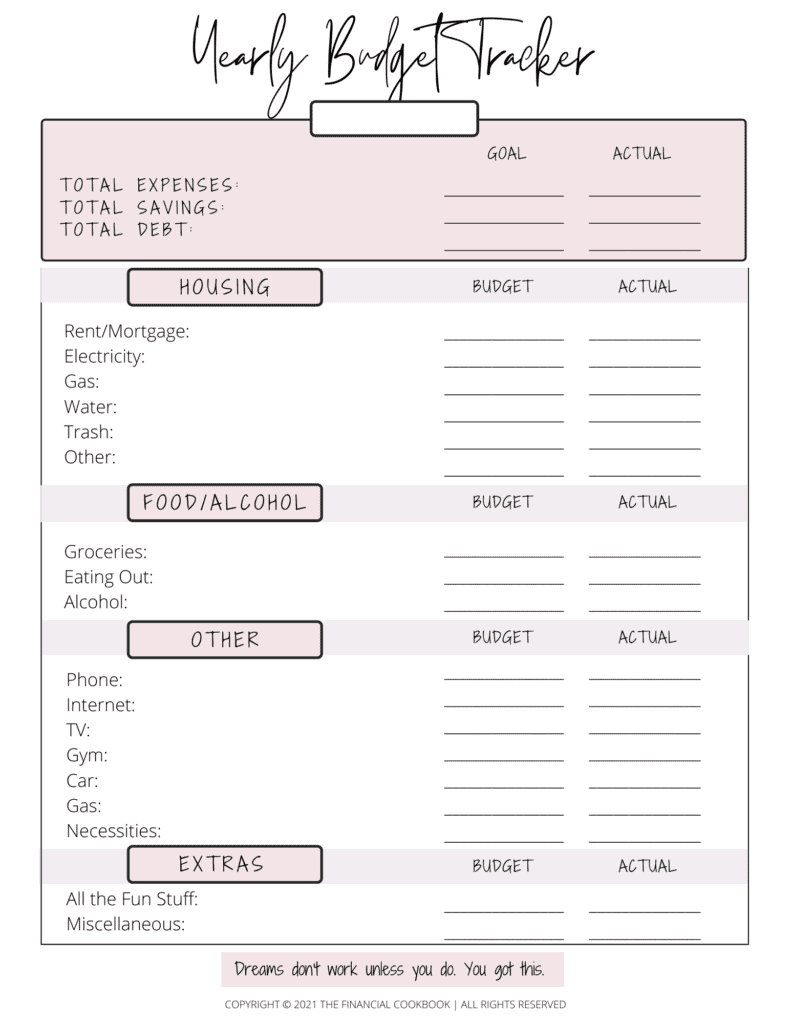

4. Yearly Budget Tracker

The next step for budgeting is the yearly budget tracker. This one will also come with the download from #2 so no need to redownload anything.

You will only print this one out once and will put it under all the months.

Next, you'll want to write in your goals for the year and then at the end of the year, you'll add up the totals from your monthly budget trackers.

You can download the yearly budget tracker here (if you already downloaded #2, you already have it in your email!)

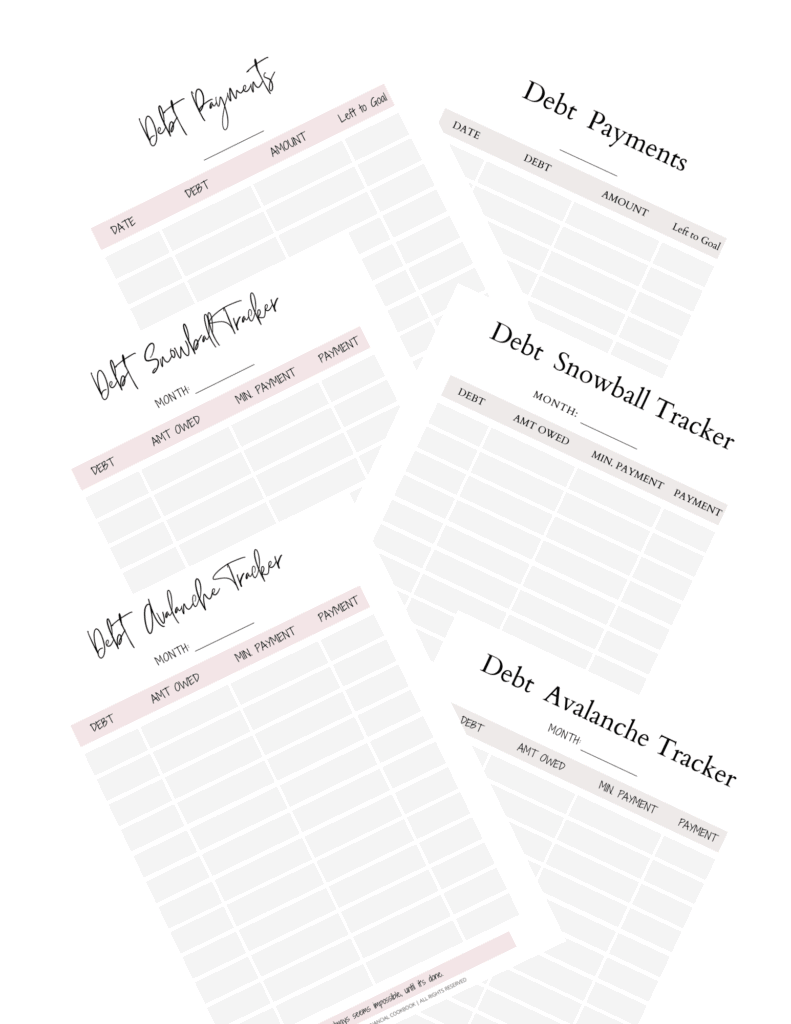

5. Debt Payoff Trackers

The next section of your free personal finance organizer is the debt payoff trackers. This one comes with a debt tracker and debt payoff strategy printables.

If you have debt, these are the best printables to use BECAUSE they go by TWO different proven debt payoff strategies.

I explain both strategies and you can choose which one makes more sense for you. I explain the differences between the two and the advantages of each. Everyone is different so the printables correlate to each debt strategy so that you can decide the best strategy for yourself!

These strategies have been proven to help people get out of debt quickly and even helped me pay off $90,000 in debt!

You can download the debt tracker payoff printables here.

Posts on Making Extra Money:

- Selling on EBay Will Make You the Highest Profit: 17 Reasons You’ll Make More Money

- How to Make Money on eBay: 26 Tips to Maximize Your Profit

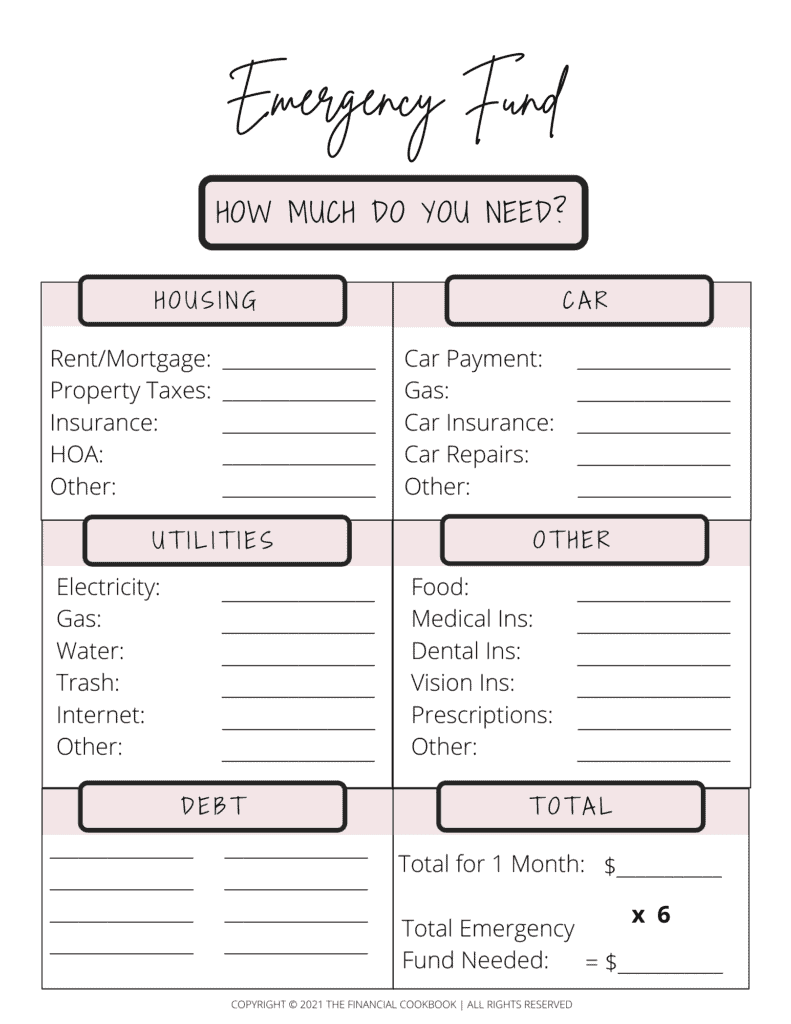

6. Emergency Fund Tracker

It is extremely important to have an emergency fund! Above investing, budgeting, and everything else, I'd say an emergency fund is the most important thing to have.

An emergency fund is a savings fund that you don't touch unless you're in an emergency. For example, if you lose your job and need money, you'll be able to use it for that. If your dog gets sick or you break your arm, these funds will help with unexpected expenses.

Figuring out exactly how much you need can sometimes be a daunting task. Don't worry though, I've got you and I laid out the framework to make it easy to figure out exactly how much you need!

This free downloadable tracker will allow you to figure out exactly how much you need to keep in your emergency fund.

Related Posts for Emergency Funds:

DIY Financial Organizer

By now, you should have a full financial cookbook of all the recipes for financial freedom! That's the exact financial organizer I used to get out of $90,000 in debt and achieve financial independence!

You can download all the printables for free and get everything for under $20 to get yourself on track with your finances!

I have many more ideas so bookmark this page as I will be making many more free printables available for your personal financial organizer.

Related Posts You'll Enjoy:

- The 5 Best Financial Books that Will Change Your Life

- Lessons from Rich Dad Poor Dad: The Finance Book That Will Make You A Millionaire

- Financial Cookbook Easy to Understand Definitions

Great Article loving the printables and financial advice I hope this can help me get organized.

Thank you so much for your sweet feedback!! You got this!

Hi I tried downloading a goal tracker but it it didn’t work

Oh dear! Send me an email and i’ll get it over to you! Check your spam folder as well =)

Love this! I am more digital oriented though so would love to see something in Google Sheets or Excel to organize all of this.

Hey Kelsey! I’m glad you like it! I actually have that on the website. Check out my net worth tracker. That’s how I organize everything via excel =)

I am so grateful I found your webste/blog! The information you have provided has changed my financial health dramatically. I was never taught about finance, budgeting or investing. Your information has changed all of it for me. I can’t THANK YOU enough!!

Awww, you are so sweet!!! I’m SO glad it has been helpful!!! Aiming to change the narrative for women. =)